Let’s start with a few historical observations:

- Equity markets have gone up 80% of the time when viewed on a 6-month rolling period. They have experienced 10% or greater declines over a 6-month period approximately 10% of the time.

- Of the worst downturns over the past 60 years, the market has recovered to its past high within 18 months… on average.

- Equity markets reach their low before the worst of the economic downturn.

- Emotional response to market volatility results in investors losing more than 25% of the market’s opportunity.

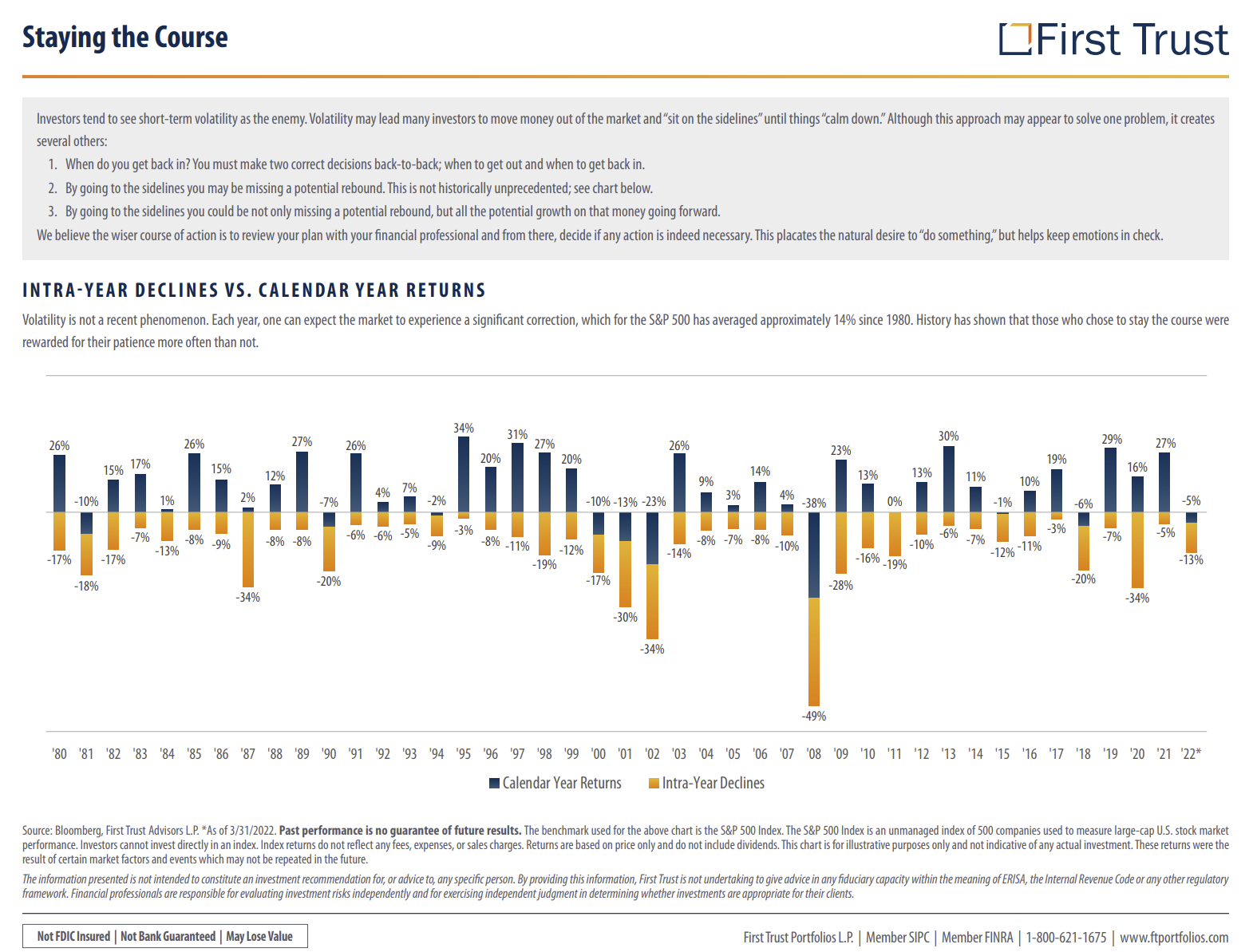

- The downturns do not necessarily lead to negative annual returns.

We have discussed the instabilities in the markets and the economy. We have been adding to our cash positions since Thanksgiving of 2021 as we looked to mitigate an expected adverse market environment. In the first quarter of this year, some questioned as to why we were not fully invested. Now that the major indices are down 20% to 30%, we are being asked why we are not fully in cash. The answer is we look to be approximately right rather than precisely wrong. To have the confidence to move to an extreme requires much more than a recession. It would likely require a banking crisis.

There is little doubt that the inflation wave we are experiencing and the fight against it will be painful. And the markets will have to reflect it. Which they are. Now.

Investment markets—both equity and fixed income—discount future events. When those anticipated future events are positive, no one questions that discounting. However, when the future becomes darker, the downward adjustments are not easy or graceful. When the market is finding its correct level, the changes are typically abrupt, halting, and clumsy. Of course, dramatic data and big swings between the ups and the downs can make people feel uncertain and out of control. The danger is when feeling like that brings people to act on fear and regret—regret that “I should have sold all of my portfolio in…”

Consider, however, that historical market movements have demonstrated the best time to buy (or sell) is when the opposite action would feel most comforting. Our models, based on pattern-recognition over decades, have been working, so we will continue to follow their unemotional and empirically tested direction.

We firmly believe that market bottoms and tops are processes and should not be viewed as discreet points in time.