David vs. Goliath: How Auour’s Unique Approach Shines

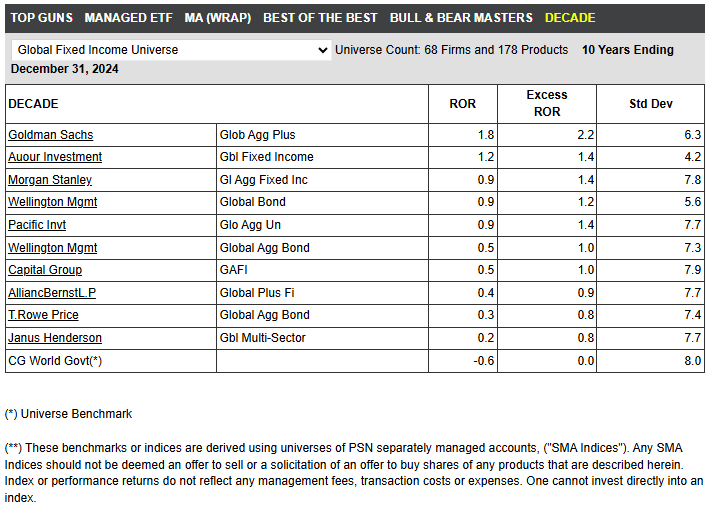

When Zephyr announced Auour Investments as the Manager of the Decade for our Global Fixed Income strategy, the recognition was a moment of pride. Naturally, it sparked curiosity: How did a boutique firm like ours, with no analysts stationed across the globe or ex-Fed officials on speed dial, outperform industry giants like Morgan Stanley, PIMCO, Janus Henderson, and Capital Group?

The answer lies in the very DNA of our firm and the principles we’ve embraced since day one.

A Different Path

The Goliaths of the investment world operate with vast research teams, global reach, and dominance in trading volumes. They have the scale and connections to uncover every inefficiency in the pursuit of identifying “the best bond” or “the best stock.” And yet, empirical evidence tells us that this relentless search is often a losing game. Historically, the Goliaths have not consistently outperformed through their asset selection. With thousands of brilliant minds competing in the same space, inefficiencies quickly disappear, leaving little edge to be gained.

Adding to their challenges, many of these large firms rely on static asset allocation processes, hugging benchmarks to minimize the risk of deviating too far from the norm. They fear that significant deviations could harm their products or reputation. This rigidity, placing their marketing needs above client outcomes, often leaves them unable to adapt to changing market conditions, further limiting their ability to deliver consistent outperformance.

Auour doesn’t play that game. Instead, we built our processes to focus on the broader view: understanding and adapting to the risks inherent in the overall market. While others pore over individual securities, we leverage low-cost tools—exchange-traded funds (ETFs)—to outperform them through dynamic and intelligent asset allocation. Using passive ETFs reduces costs while gaining the precise exposures we need to execute our strategies effectively.

“Our dynamic approach adapts to market conditions, outperforming the Goliaths through intelligent risk management and cost-effective strategies.”

Active Navigation, Not Static Drift

Think of static asset allocation as sending a fleet of sailboats across the Atlantic, setting the sails at the start, and hoping some reach the destination unscathed. It’s a gamble on fair weather. At Auour, we approach investing like experienced navigators, constantly monitoring for storms, shifting winds, and hidden icebergs. Our active approach allows us to adjust course when conditions change, aiming for the best outcomes regardless of what the market throws our way.

Our focus on risk is not just about avoiding the obvious storms but also understanding the undercurrents that can subtly shift the market’s trajectory. We analyze factors such as credit costs and availability, momentum, valuation, and the interactions of markets across the globe to gauge how the market’s attitude toward risk evolves. By combining data-driven insights with a disciplined approach, we seek to protect against downside risks while positioning our portfolios to seize opportunities when the environment turns favorable.

This dynamic strategy—paying attention to how market attitudes towards risk shift over time—has been the cornerstone of our success. By focusing on risk, not predictions, we’ve managed to rank second in overall return and first in risk-adjusted return during our first decade. That’s no accident; it’s the result of our disciplined process and our commitment to looking at the bigger picture.

Dynamic Doesn’t Mean Tax Inefficient

One misconception about dynamic asset allocation is that it leads to tax inefficiency. At Auour, we’ve demonstrated this doesn’t have to be the case. All our products are built on the same foundation of monitoring and adjusting to risk. Though our strategies are dynamic, they are strategically dynamic, making moves only when needed and always with an eye toward tax efficiency.

“Dynamic doesn’t mean tax inefficient—our strategies minimize tax drag while maintaining the flexibility to seize market opportunities.”

Our demonstrated results speak for themselves. Despite being dynamic, our strategies have produced less tax drag*** than the Goliaths’ comparable solutions. This approach allows us to aim for the best of both worlds: dynamic, risk-adjusted strategies that adapt to market conditions while minimizing unnecessary tax burdens for our clients.

Disclosures

Past performance is no guarantee of future returns. All investments carry the risk of principal loss. Auour Investments, an investment advisor registered with the U.S. Securities Exchange Commission, did not pay for this recognition.

(*) Universe Benchmark

(**) These benchmarks or indices are derived using universes of PSN separately managed accounts, (“SMA Indices”). Any SMA Indices should not be deemed an offer to sell or a solicitation of an offer to buy shares of any products that are described herein. Index or performance returns do not reflect any management fees, transaction costs or expenses. One cannot invest directly into an index.

(***) For our purposes we have calculated tax drag based on the current federal tax rates for a family with an annual income of $400,000.

Top Guns Manager of The Decade Critria: The PSN universes were created using the information collected through the PSN investment manager questionnaire and use only gross of fee returns. PSN Top Guns investment managers must claim that they are GIPs compliant. Mutual fund and commingled fund products are not included in the universe. Products must have an r-squared of 0.80 or greater relative to the style benchmark for the latest ten year period. Moreover, products must have returns greater than the style benchmark for the latest ten-year period and also standard deviation less than the style benchmark for the latest ten-year period. At this point, the top ten performers for the latest ten-year period become the PSN Top Guns Manager of the Decade.

The content of PSN Top Guns is intended for use by qualified investment professionals. Please consult with an investment professional before making any investment decisions using content or implied content from PSN Top Guns.

All Rights Reserved. PSN Top Guns is powered by PSN. PSN is an investment manager database and is a division of Informa. No part of PSN Top Guns may be reproduced in any form or by any means, electronic, mechanical, photocopying, or otherwise without the prior written permission of PSN.

PSN Top Guns relies on data provided by third-party sources. Because of the possibility of unintended human or mechanical error that might occur, PSN does not guarantee the accuracy, adequacy, completeness or availability of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. THERE ARE NO EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. In no event shall PSN be liable for any indirect, special or consequential damages in connection with use of any information or derived using information based on PSN Top Guns results.