Determining the characteristics of superior investing is not a new idea. We hazard a guess that since the first dollar went into the public markets, individuals have spent considerable effort determining short cuts and tricks to identify the items that drive outperformance. Within the modern investment world, both academic and industry attention has been focused on finding those measurable items across large swaths of the market that can help in predicting or explaining both return and the risk present to achieve superior returns.

Within the confines of investment geeks, these items or characteristics are called ‘factors’ and have earned the well-deserved reputation of describing a large portion of the returns and risks experienced within the investment universe. Though cheap computing power and increased attention has expanded the number of factors professionals use, the three core components have not changed: value, company size, and momentum. These three core factors as a whole have been steady in their explanatory power when it comes to describing market perturbations.

Though the three have been time tested, their contribution is not static; there have been periods of time when one factor has proven more powerful than others. In other words, depending on only one can turn out to be a large mistake as they have shown to be highly cyclical. Our desire in this letter is to draw our readers’ attention to a successful, yet dangerous, marketing approach by some that advises putting all of an investor’s eggs into one basket. That basket is momentum.

When looking at these factors, much information can be gleaned on how they act and the value they offer. We look below at some of the items that concern us about relying only on the momentum factor.

It works until it doesn’t…

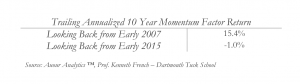

Given the maturity of this topic, the investment community has enough data available to show that no one factor, including momentum, can do a good enough job on its own to help one outperform. Though each factor has shown itself to be quite powerful in specific investment environments, its contribution can vary. This is demonstrated in the table below, showing that the contribution from momentum was very strong for the 10 year period entering 2007. Unfortunately, it lost its mojo when viewed from the beginning of 2015. In other words, if you had chosen to follow the momentum strategy in 2007, given the exceptional historical power it displayed, you would have been sorely disappointed in its performance once you went in.

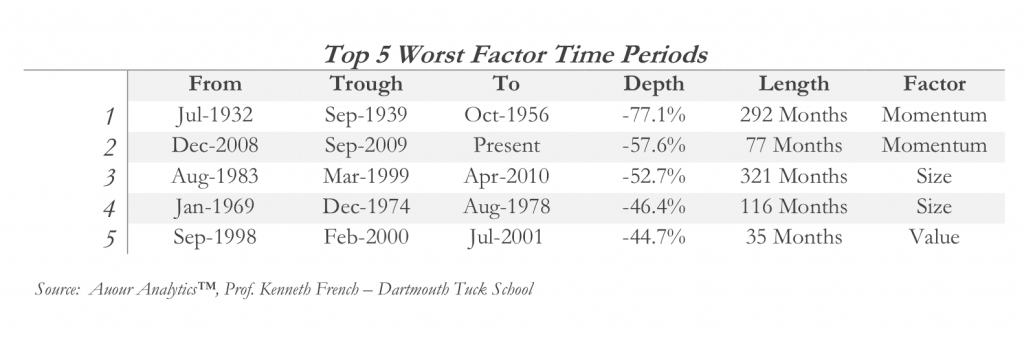

And when a factor fails to add value, it will vary in its severity of underperformance. Momentum has proven to be one of the most volatile factors and the worst when it comes to causing significant capital loss when it goes bad.

…and then it is likely not to work for a while…

The idea that a factor may show less value in some environments is not surprising. It would be too easy if it were! What we have noticed through our analysis is that factors lose their predictive power in different ways. For momentum, it has shown not only the largest amount of downside production (as shown in the table above), it has also shown through history to stay out of favor for longer periods. As an example, the performance attributable to momentum strategies was highest in the 1990’s, culminating in its best performance right at the top of the Tech Bubble. However, the good news ends there. The performance of momentum-based strategies produced lackluster results in the 2000’s and the factor has yet to earn its way out of the hole it dug for itself in the late 2000’s. Important to note, at least to us, is the long time periods of underperformance that some of these factors demonstrate. Hoping for a quick turnaround after a downturn is just that, hope. And hope is not a strategy worth following.

…with the costs being high for sticking with it.

The last item that we want to highlight is the cost to implement and follow a strategy built only on momentum. Even when performance is good, one needs to pay attention to the costs to obtain it. And for a momentum-only investment style, one will see considerable turnover of positions causing significant tax consequences and transaction costs. According to MSCI, a momentum strategy requires five (5!) times more trading than other factor-based strategies , making momentum-only strategies costly to a taxable investor.

To Sum Up

Our desire to address the issues with momentum came not from a dislike or disbelief in the information it provides. Our attention to this topic is due to the large number of people that have embraced momentum, in isolation, and have placed large bets that they will be well rewarded for following it. We find that dangerous and worth highlighting to our community. Do not misunderstand us, momentum is one of many factors that we use to better serve the needs of our clients. It, like the other factors we use, has some wonderful properties that play well with others. It has a home, or should have a home, in a broad based and durable investment process. To ignore its predictive power would be foolish, but not as foolish as relying on it as the sole factor in one’s investment process.