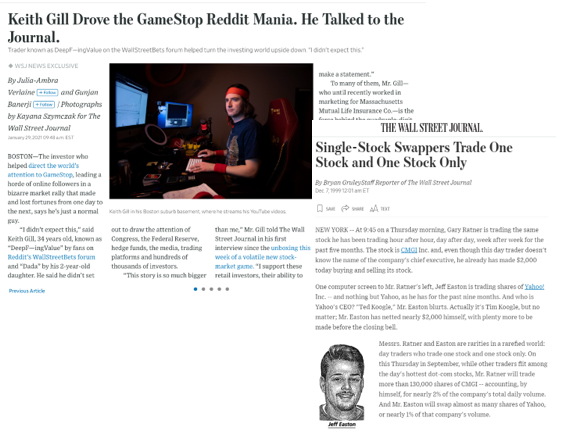

It has always puzzled us when relatively recent history repeats itself, especially since we have the ability to study and apply lessons from the past and alter our behavior. Nevertheless, we feel we are reliving 1999 and 2000 today, with the current dramatic rise in the share prices of a select group of securities, the rush to own them at any price, and the unrelenting activity of a new crop of market participants.

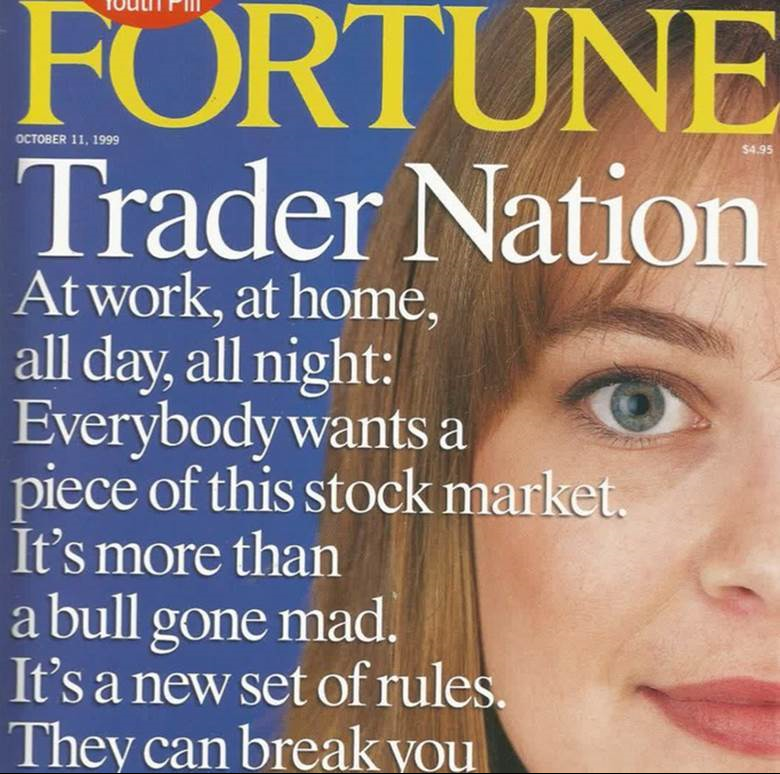

Anecdotes can be a crutch for writers because there’s always one that can be trotted out to prove any point. That said, several taken together can show the contours of a pattern. In that spirit, we share some recent incidents that highlight ways in which we are essentially re-living the dot-com bubble. First, take the recent coordinated behavior of a group of small investors buying individual stocks, including GameStop and AMC Theatres, causing a market rally based entirely on momentum. This activity is not a new phenomenon: in 1999, individual small investors were similarly trading hot tech stocks, such as Yahoo, CMGI, AOL, and Sun Microsystems. (Note the similarities between the two phenomena as recounted in a recent Wall Street Journal article about Keith Gill, the man behind the GameStop move, and the Journal article on the individual traders running up Yahoo and CMGI in December 1999.)

Anecdotes can be a crutch for writers because there’s always one that can be trotted out to prove any point. That said, several taken together can show the contours of a pattern. In that spirit, we share some recent incidents that highlight ways in which we are essentially re-living the dot-com bubble. First, take the recent coordinated behavior of a group of small investors buying individual stocks, including GameStop and AMC Theatres, causing a market rally based entirely on momentum. This activity is not a new phenomenon: in 1999, individual small investors were similarly trading hot tech stocks, such as Yahoo, CMGI, AOL, and Sun Microsystems. (Note the similarities between the two phenomena as recounted in a recent Wall Street Journal article about Keith Gill, the man behind the GameStop move, and the Journal article on the individual traders running up Yahoo and CMGI in December 1999.)

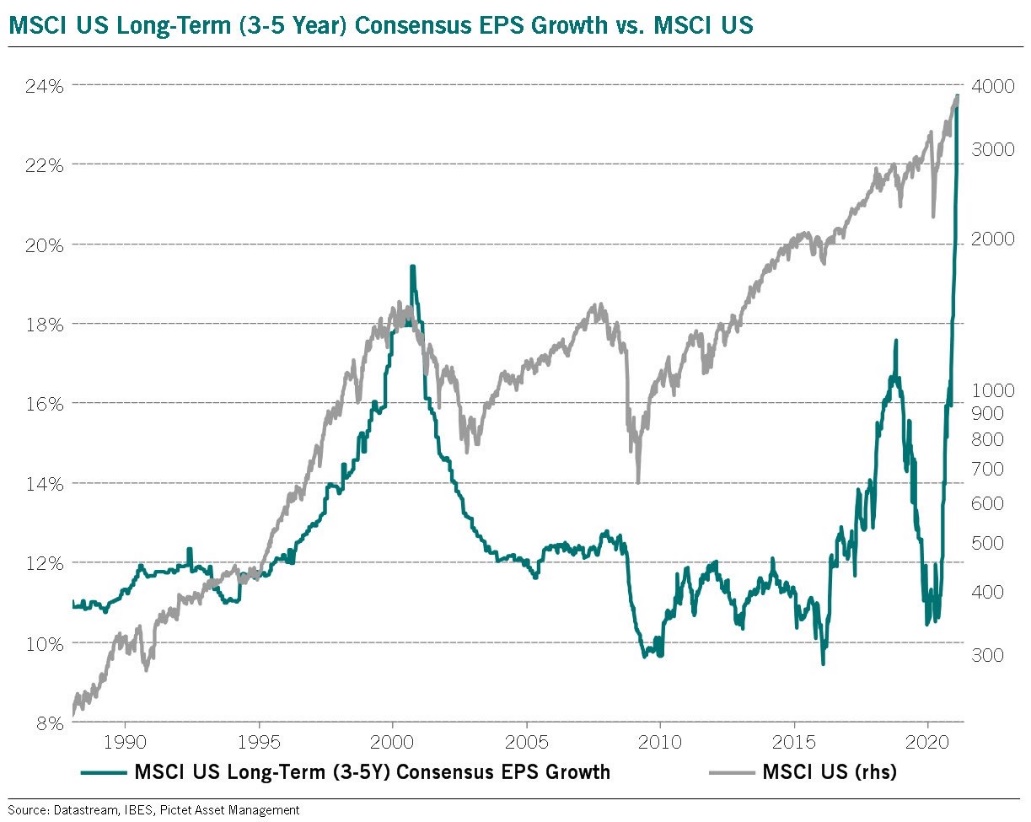

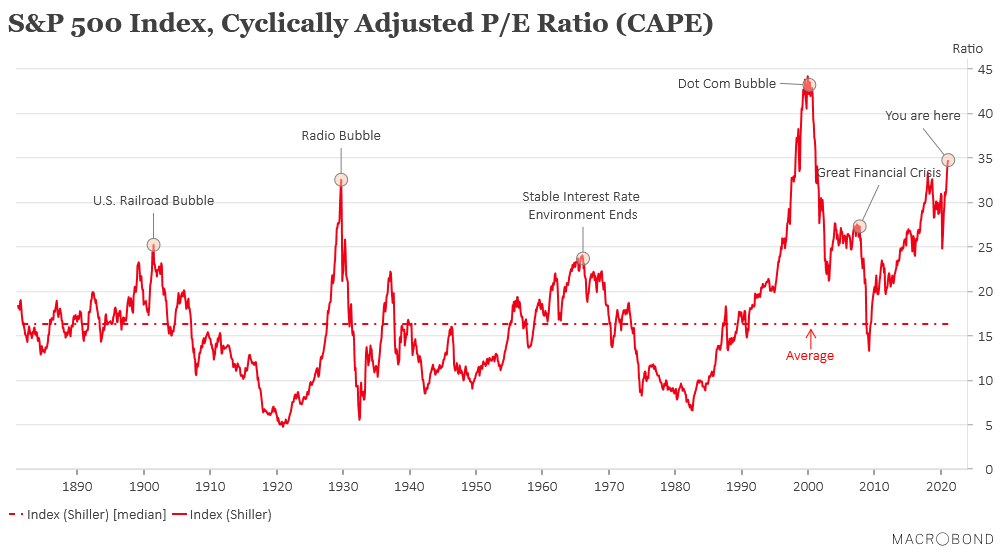

As in 1999, optimism has taken hold today that assumes the future is well defined and without complication. We are long-term optimists, but we do not see a future without hurdles. And we believe the aggressive ramp-up in growth expectations today is overly optimistic. The consensus outlook is for corporate earnings to grow almost 24% each year for the next 3 to 5 years—higher than the growth outlook in 1999 and 2000.

As in 1999, optimism has taken hold today that assumes the future is well defined and without complication. We are long-term optimists, but we do not see a future without hurdles. And we believe the aggressive ramp-up in growth expectations today is overly optimistic. The consensus outlook is for corporate earnings to grow almost 24% each year for the next 3 to 5 years—higher than the growth outlook in 1999 and 2000.

Although we sometimes have issues remembering what we had to eat last night, we have a crystal-clear memory of the dot-com bubble. Innovation was rapid; new companies brought new opportunities for growth; and profits were right in front of us, as scale promised market dominance. We have a feeling of déjà vu. Once again, heady optimism is being applied equally to many companies within the same space because it’s unclear who among the numerous competitors will dominate. The consequence of pricing all players as sole winners of their market, of course, is unrealistic valuations and outsized profit expectations. Not every company can win.

In the aftermath of the dot-com bubble, we saw a select few reaching critical mass, and excess capacity removing most of the others. The early years of this century were a period of recovering from past malinvestments. We fear the same is going to happen again.

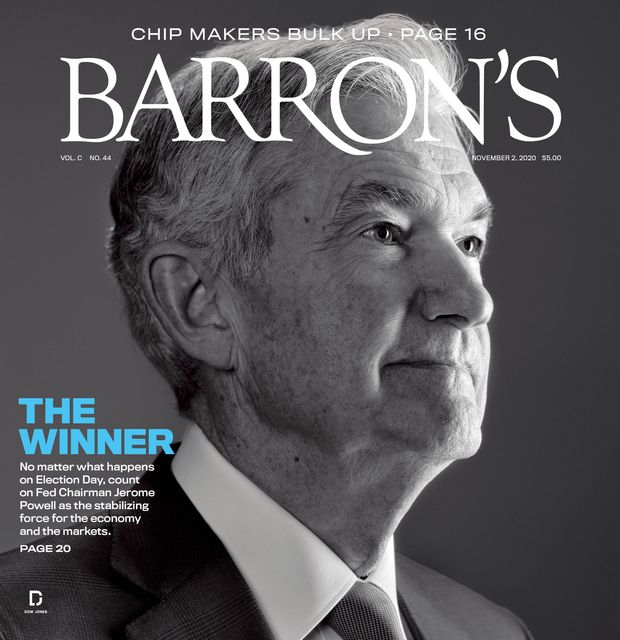

Another similarity between the dot-com bubble and today is our central bank, the Federal Reserve. Remember, leading up to “Y2K” was a massive investment cycle into technology to prepare for the turning of the century. All knew it was coming, but few knew the ramifications. People feared that systems would think a person reaching their 100th birthday would be seen as a newborn, flight control systems would fail to operate, computers would not turn on, and pay cycles would be missed. To protect from the possibility of the world shutting down, the central bank flooded the financial markets with liquidity. In the February 15, 1999, issue, Time presented the central bankers as saviors who prevented a world meltdown. Sound familiar?

Bubbles make it uncomfortable for those of us arguing for caution and patience. We find ourselves in that position now. Liquidity is plentiful, pandemic recovery is underway, and optimism is high. Some embrace a thesis that today’s activity, though similar in shape and form to 1999 and 2000, is somehow dramatically different. We do not.

We sit in a position of cautious participation. We are roughly 70% invested relative to our mandates. We are far from hiding under our desks, loading up on guns and butter, or honing our survival skills. We have seen times like this before, though, and now is not the time to be fully invested.

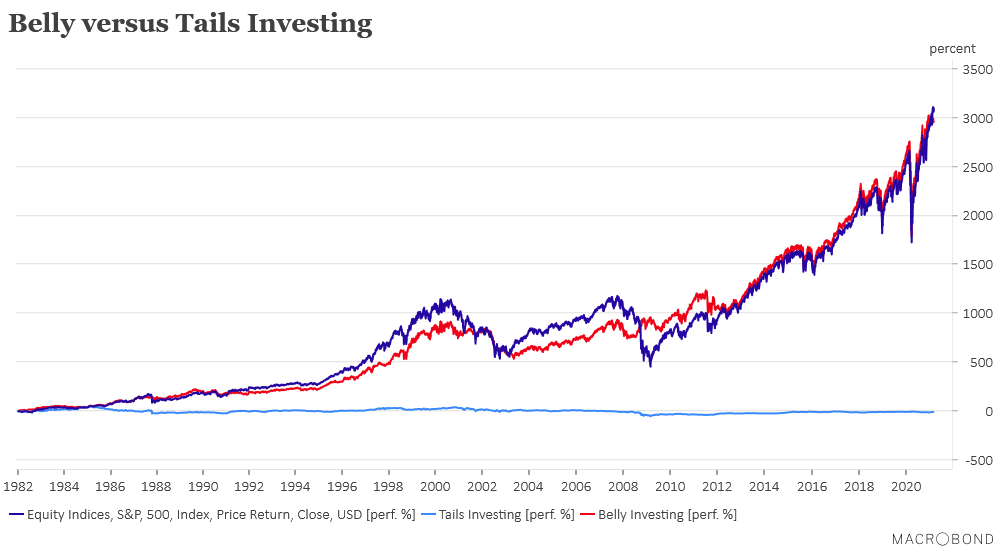

If you reflect on the fact that the best time to be fully invested is when markets are relatively boring, our approach might seem more intuitive. We see the times when the markets get riled up—via massive moves higher or lower—as times to walk slowly and guard against outsized moves that could cause regret. We refer to our approach as belly versus tails investing. The belly describes the bulk of financial history, in which market movements are routine (i.e., within one standard deviation of their long-term averages). The tails occur when the markets show extreme behavior, driving prices up or down.

We can show that if you avoid the market’s most extreme behavior, you can reap all of the market’s potential. As shown below, in an overly simplified view of this thesis, if we were to only be invested in the equity markets when they are considered boring (the belly of historical return distributions) and to be fully out of the market when it gets too exciting (the tails of return distributions), we can get to the same endpoint as the market without undue excitement.

We can show that if you avoid the market’s most extreme behavior, you can reap all of the market’s potential. As shown below, in an overly simplified view of this thesis, if we were to only be invested in the equity markets when they are considered boring (the belly of historical return distributions) and to be fully out of the market when it gets too exciting (the tails of return distributions), we can get to the same endpoint as the market without undue excitement.

We have discussed how current valuation levels are historically high, nearing the valuations witnessed in 1999 and 2000 and surpassing those seen in 1929. These valuations, combined with the exciting news of likely herd immunity in 2021, plus the high levels of stimulus being pumped into the world’s economies, mean no one is yawning with boredom. For those of us looking for calm, this signals we should move away from the trough. And on that note, we’ll end with this classic idiom: “Pigs get fat, hogs get slaughtered.”

One more flash from the past.