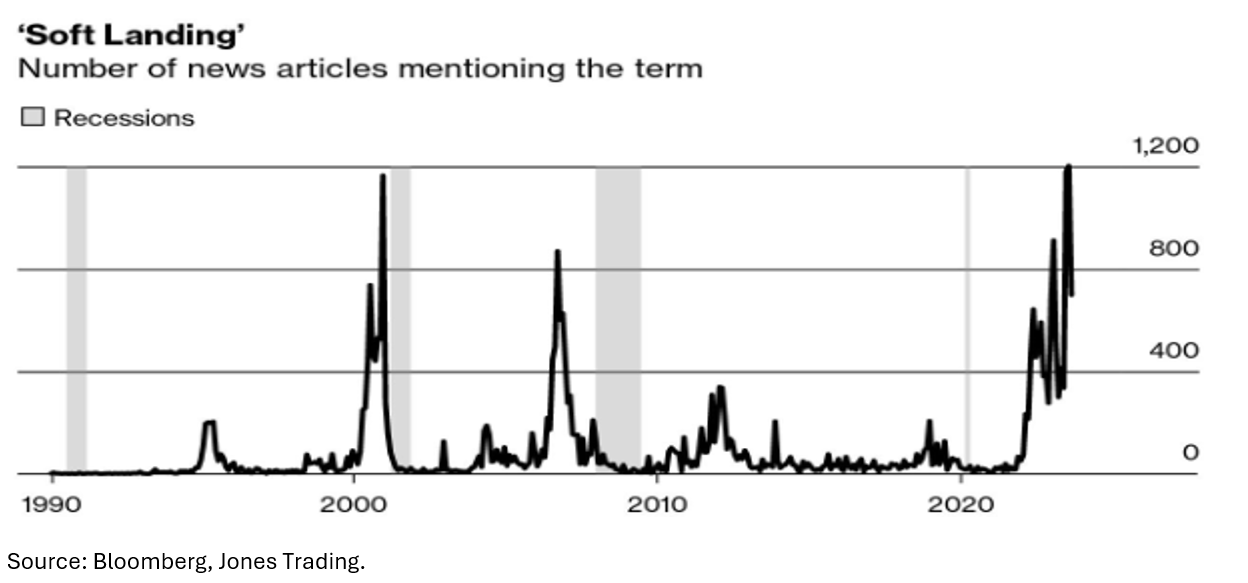

Recently, we’ve been confronted with a few questions: Is it possible that we might avoid a recession? Has inflation been controlled without a surge in unemployment? And, can banks and commercial real estate weather the Federal Reserve’s significant rate hikes? The graphic below, depicting how often the term “soft landing” was used in the news, shows perhaps the hope we have gone through the worst.

The one question we never get asked but are asking ourselves is, “Is it possible that interest rates must go even higher to bring inflation under control?”

While we are nearly fully invested in all our strategies (with Global Fixed Income sitting very defensively), we cannot ignore the potential need for higher rates across the yield curve to combat inflation. If and/or when that becomes a reality, we may find ourselves navigating more challenging times because the market is not pricing in a higher-for-longer scenario at all.

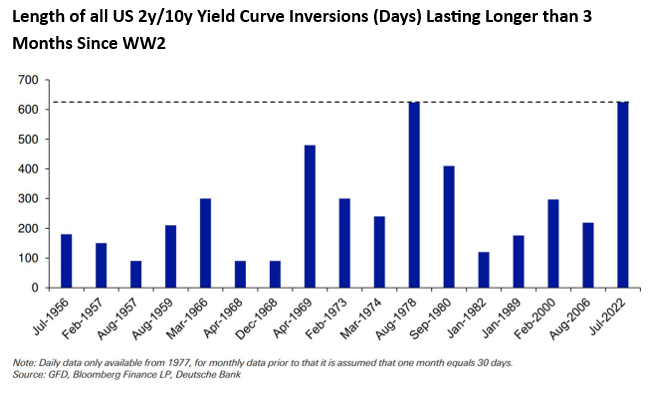

This disbelief is evident in the current interest rate yield curve. Since World War II, the yield curve has never been this inverted—meaning that the short-term rates are higher than the long-term rates—for this long. Looking further back, the only other time it was longer was in 1929. (We won’t go there).

Believing that interest rates should return to the lows we saw over the last decade is an emotional belief. It’s also been a contagious one. We say “emotional” because no empirical evidence exists that such a scenario would fit within any historical context. Yet, the global debt markets, especially the U.S. debt markets, are building in a “soft landing” as the base case, unwilling to place any material probability on a bad case.

Why are we at Auour being such downers?

Why can’t we bask in the ever-higher equity prices, the tame fixed-income markets, and leave things be?

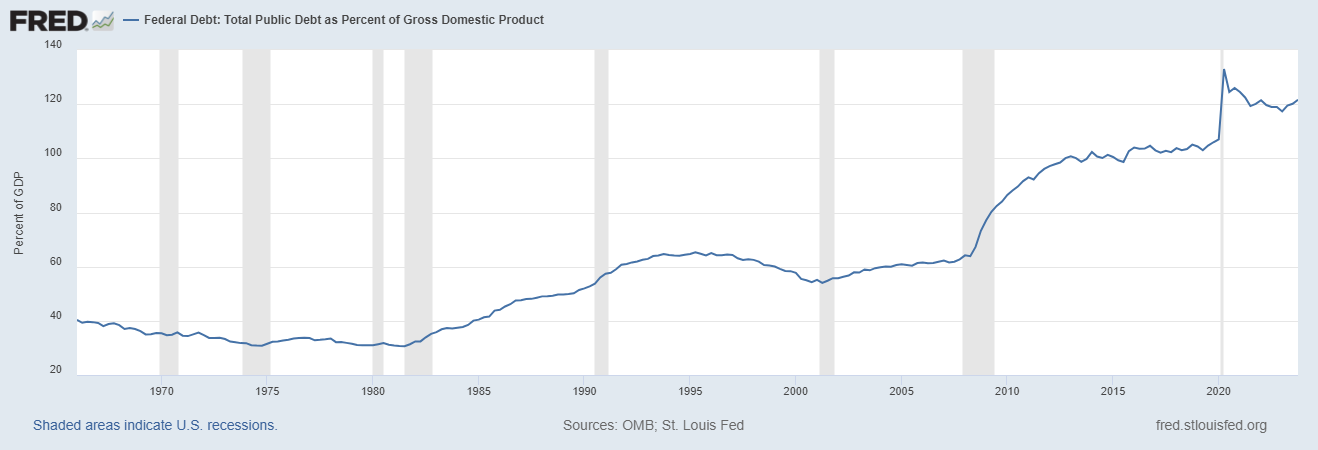

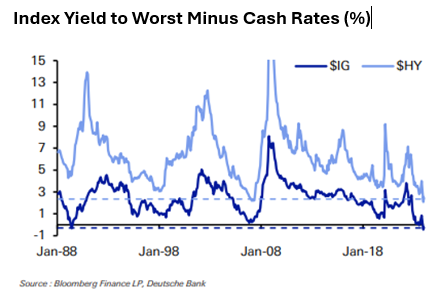

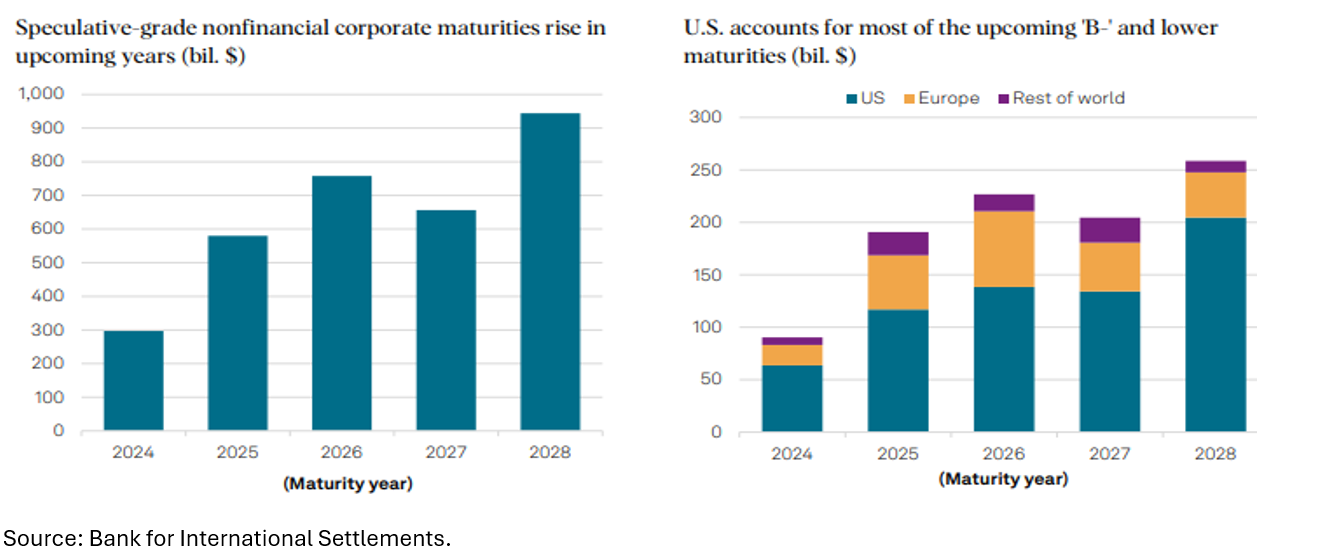

Because the federal debt is currently 121% of GDP, with no significant political resistance to the ongoing inflationary deficit spending. As the government offers higher interest rates to support this spending, there’s a risk that private-sector borrowing will be squeezed out. Why take the risk when you can just buy treasuries? The difference in interest rates between government debt (considered virtually risk-free) and private sector debt is at unprecedented lows, reflecting a highly optimistic scenario. Over the next four years, more than $2.5 trillion in low-quality corporate debt will need refinancing. Additionally, we are facing persistent inflation, which might be structural rather than cyclical, potentially leading to a more challenging environment for consumer spending.

Let’s look at some charts to illustrate our concerns.

GDP growth has been surprisingly strong. Even with that, the growth in federal debt continues to outpace it.

The chart below shows the historical interest rate spreads for investment-grade and high-yield debt. The current spreads are the tightest they have been since the late 1980’s suggesting premium pricing (which equals low implied debt costs) and no room for error if rates move higher or economic default scenarios need to be built into expectations.

One may argue the positive side of this situation is that companies have locked themselves in low interest payments. And that is true, up to a point. Unfortunately, much of that debt is nearing maturity and needs refinancing. (Imagine a world where you had locked in a 3% mortgage on your house but needed to refinance it at current rates.) In the case of corporations, the refinancing discussion will be around a higher interest rate and a lower level of appetite for as much debt by investors, pushing management teams into an uncomfortable situation. The charts below show the amount of debt that is in need of refinancing over the next few years.

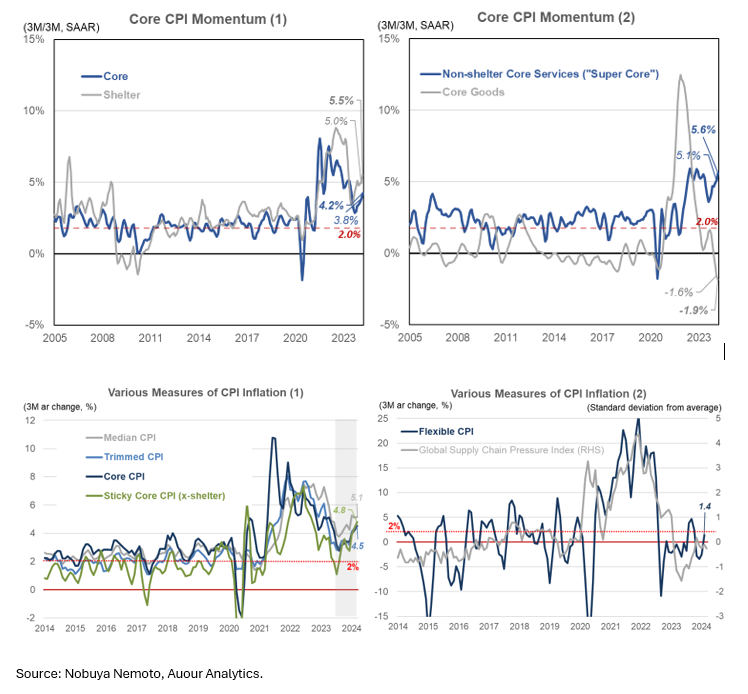

If rates fall, the situation for corporations depicted above may not be that big of a deal. What would allow rates to drop outside of a collapse in the economy? A tame inflationary environment. But that doesn’t appear to be in the near future, as we are now seeing a re-acceleration in inflation, as shown in the inflation measures below.

With such a high level of emotional contagion, it’s crucial that we respect the empirical evidence and not become complacent in the belief that we are through the storm. As we wrote in the fall of 2023, it is only now that we are entering a period of heightened risk of an economic downturn. Those who expected it in early 2023 did not respect history: it takes time for rising rates to impact economic growth.

Market prices reflect companies’ past growth, current profitability, and future growth expectations. Sometimes, those three can combine to create a feeling of invincibility. We see that now in both the equity and fixed-income markets. Those feelings can change quickly, as we experienced at the start of the pandemic and during the fall of Silicon Valley Bank. In those cases, the U.S. central bank quickly pushed more money into the system as deflation was feared or inflation appeared to be peaking. But now, those two outcomes seem hard to envision.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.