We founded Auour Investments in early 2013 and spent the spring and summer building the Auour Regime Model and constructing the investment processes underlying our strategies. In the fall of 2013, we launched the first of the Instinct family of dynamic core strategies: Global Fixed Income in October and Global Equity in December. The growth in assets has been rewarding yet we have had little or no help from the financial markets.

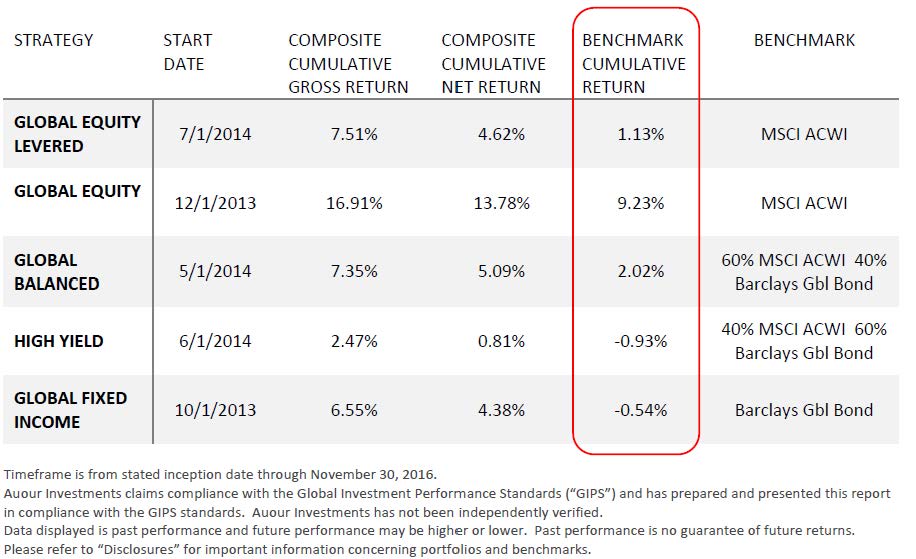

Since the launch of the strategies, the equity markets have experienced a total return of 9.2% over a three-year period[i]. That equates to around 3% per year in equity returns when the historic average is closer to 8%. Not really a bull market from our perspective. The fixed income markets[i] were not that exciting either, delivering a total return of -0.54%. The markets look even less helpful when you calculate the returns during the times we launched our additional three strategies.

Sir John Templeton, one of the wiser investors in modern times was quoted as saying “Bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.” If we use that quote as a gauge, we do not see markets as meeting either end of the spectrum. Guarded yet participating may be the result that fits the current environment.

As we stated in a recent newsletter, we have been the participants of global experiments dating back to the start of the European Union. Some of those are ending now while others will continue and news ones start up. We will be addressing those in some greater detail in January as we elaborate on our insights into 2017 and beyond.

We wish you all a safe, festive, and relaxing holiday season.

Best regards,

The Auour Investments Team