Some may think of us as bubble detectors. We choose to see ourselves, instead, as risk managers. They might be different sides of the same coin: We look across the global markets to gauge to what degree they are being moved by greed or fear, with the aim of removing client assets from the market before those emotions become dangerous to all market participants.

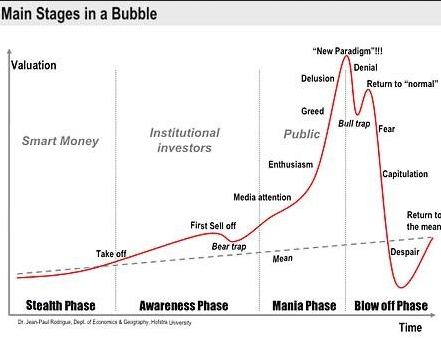

When viewed in the context of the graph above, one could argue every asset is at some stage of bubble. The problem—and the opportunity—lies in understanding the size of the bubble, its chance of bursting, and whether or not it’s of a magnitude to impact the general economy. When the bubble in the technology, media, and telecommunications sectors burst in 2000, many felt the effects, but the global banking system wasn’t crippled. The repercussions of the housing bubble of the mid-2000’s, however, were severe. When it burst, it materially weakened the financial sector, which is the grease that allows the economy to operate smoothly.

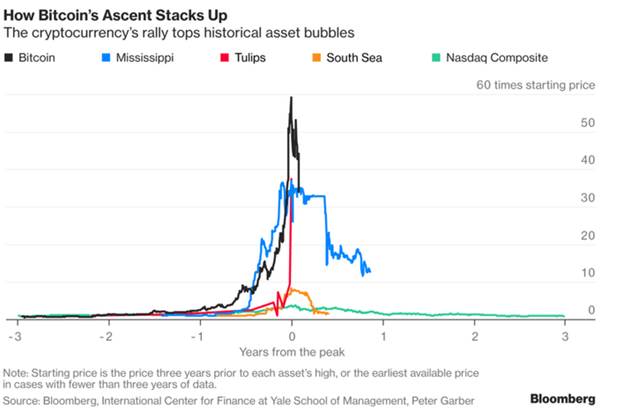

It has been 10 years since the housing bubble burst. The easy money and low-rate environment the world’s central banks have forced on us have likely created new bubbles or allowed mature ones to reach new heights. As one headline-grabbing example, the bitcoin market and the untested “asset” of cryptocurrencies appear to be experiencing just such a bubble. While we don’t want to diminish the magnitude of the phenomenon—cryptocurrencies have approximately $500 billion of supposed value, and many people would feel the effects of a burst bubble—the number of participants involved is limited, even if growing, and its significance to the global economy is insufficient to do great damage.

However, the world’s bond markets are, to us, an area of concern. They are far more significant in size and breadth than the cryptocurrency market. The biggest question to us is the potential magnitude of a correction in the bond market. We have been writing for the past year about the scope of the “mis-pricing” of government bonds that we believe has taken place. We have concluded, based on empirical evidence, that the U.S. economy and the inflation we have recently experienced argue for a 3% to 3.5% rate on the 10-year Treasury. All other bonds would likely need to reset to that level.

We argued that position back when interest rates were well below 2%. Now, we sit with the benchmark rate near 2.9%, a 65% rate increase. The current delta leaves a much smaller gap to overcome. We still maintain the bond market is only in year two of a decade-long bear market. We are not arguing for a material pop to rates. At this point, we think the bubble has a slow leak.

Although we’re edging closer to closing the gap between where rates are and where we think they should be, this does not mean all is clear and the markets will remain calm. We believe that the slow rise in rates will adversely impact some vs. others, and we need to be diligent in our understanding of the mounting stresses. Recently, we have been presenting on the five areas that may have benefited the most from the bond bubble and likely have more at risk from any burst. The presentation is available upon request by clicking here. The area of most concern to us is the municipal bond market.

We wrote in our 2018 Outlook that the municipal bond market is exhibiting a troublesome combination of greed on the parts of politicians and complacency on the part of investors. Greed and complacency are not characteristics you want to see combined when applied to a financial asset.

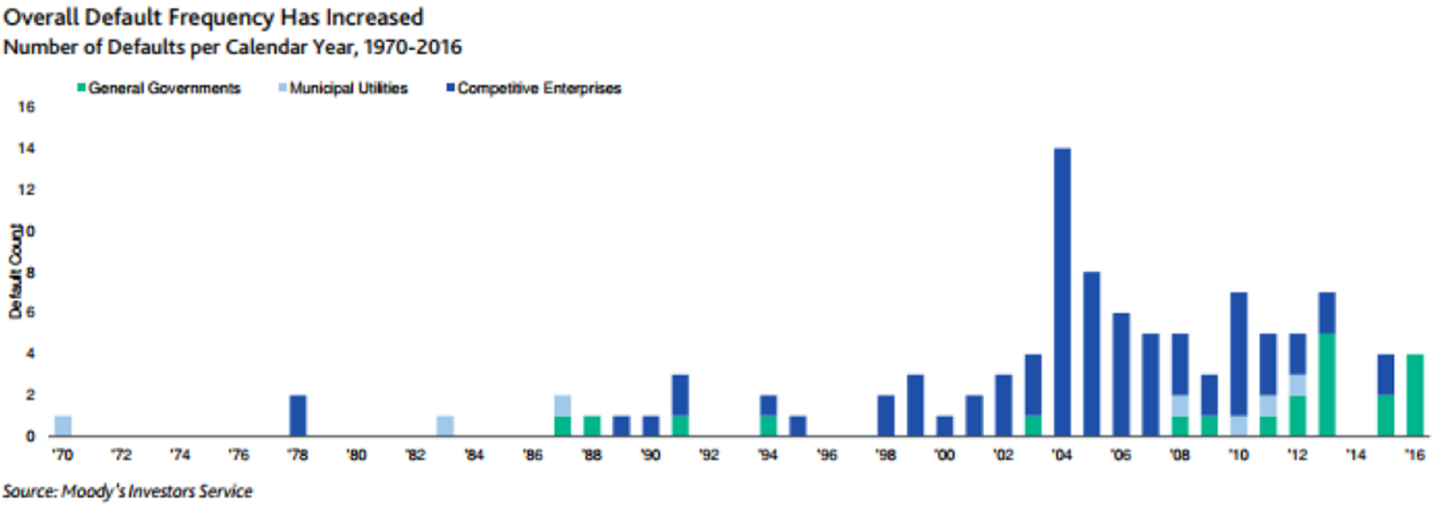

We have highlighted the rising number of defaults occurring within the municipal bond asset class.

… and are increasingly concerned that the defaults have been rising as rates have been falling. Can you imagine what might happen if the cost of funding debts increases?

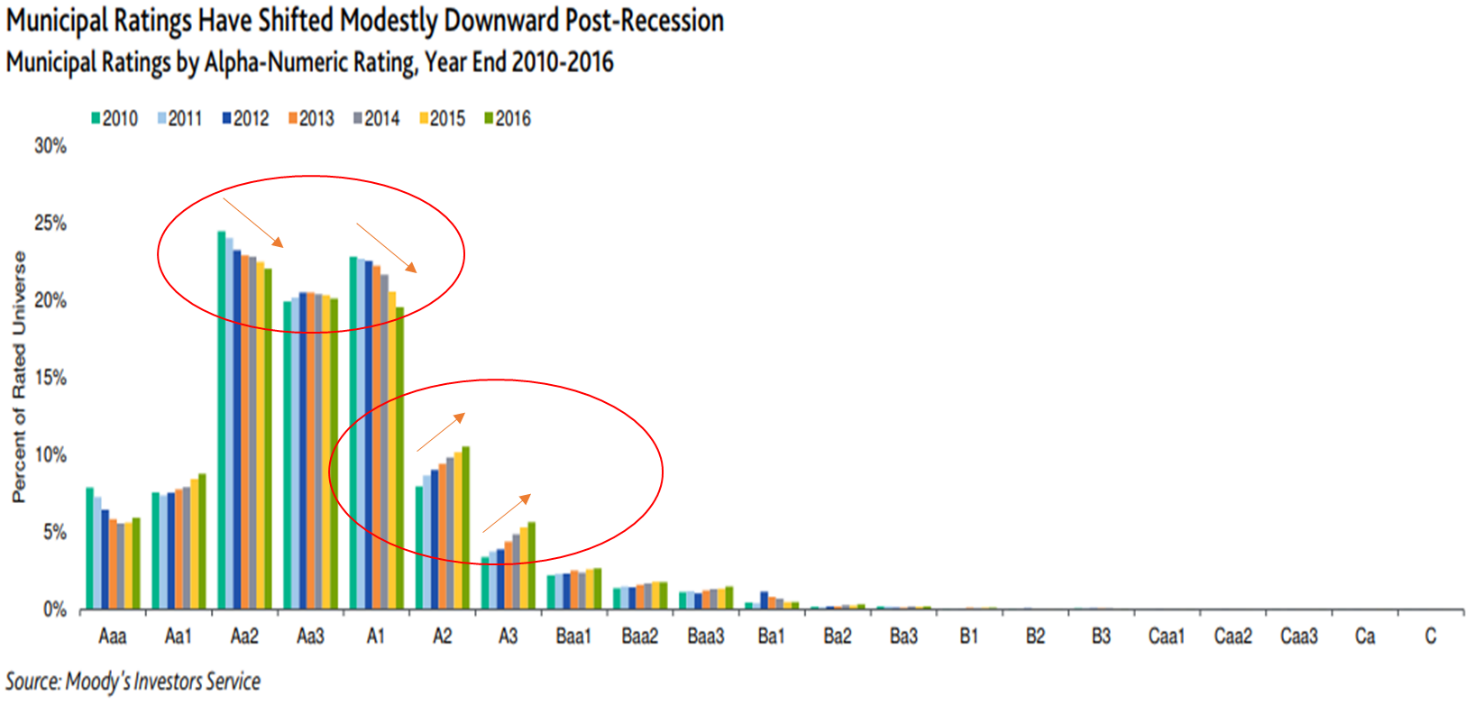

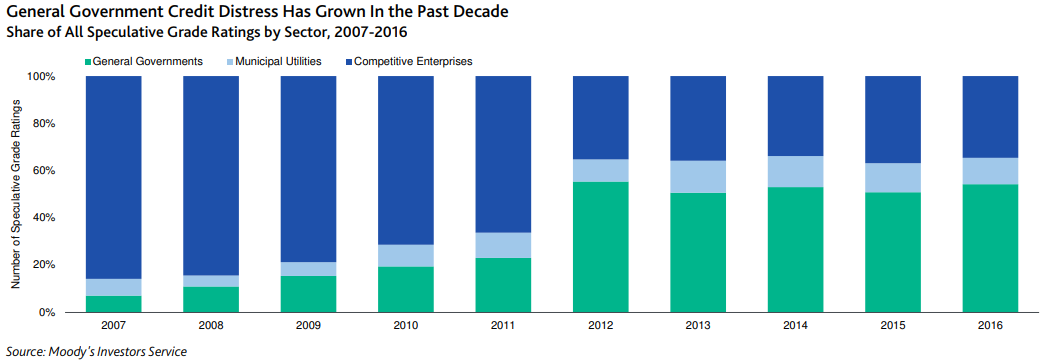

We have already seen the health of this asset class, as depicted by the credit rating agencies in their ratings of municipalities, showing a decline for the past 6+ years.

Of course, one cannot paint all municipal debt with one brush. Municipal bonds come in varying levels of perceived safety. The riskier types (hospitals and housing) have typically seen the greatest levels of defaults. However, that is changing.

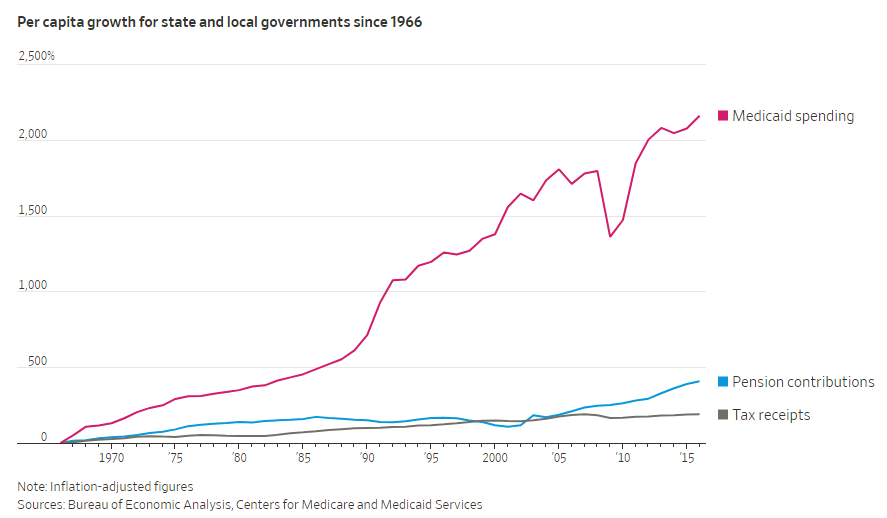

Since the financial crisis, we have seen rising levels of distressed general government debt. In the past, tax collections were considered one of the safest forms of revenue. That hasn’t changed, but the growing balances of rock-solid liabilities (pensions and Medicaid) have overwhelmed the ability of tax revenues to cover debt obligations.

Some may argue that defaults are infrequent and that the tax base cushions the harm from default. We would respond with the following historical notes:

- In 2012, the trouble in San Bernardino, Calif., resulted in a recovery rate (i.e., how much of original loan amount was able to be captured by the bondholders when it came out of bankruptcy) of 55%. (That means holders suffered a 45% loss).

- In 2012, Stockton, Calif., had a recovery rate of 50%.

- In 2008, Vallejo, Calif., bondholders experienced a 40% loss.

- In 2013, Detroit, Mich., bondholders saw losses ranging from 27% to a mind-numbing 88%.

In the case of Detroit, pensioners who were also considered unsecured debtors (i.e., in the same bucket as bondholders) did not experience a material cut in their benefits. It should not take much to convince the reader that politics will likely side with constituents rather than the financial community during times of default. And Medicaid is also non-negotiable, relative to other liabilities. The Wall Street Journal published this article discussing the crowding out that healthcare spending and pensions have inflicted on state budgets.

Though we see some bubbles as susceptible to popping, the overall bond market does not look so extended as to make us feel the global economy and markets are at risk of material and enduring declines. However, weak spots are showing themselves, and municipal bonds appear at the epicenter of any bond instability. If you hold municipals as part of your portfolio, we ask that you consider the implications of economic storms and your ability to weather them. We see any benefit from them unable to offset the risks of owning them.

For us, we are monitoring many risks, not just the bond market, in hopes of detecting those that could cause enduring damages to the overall investment markets. Currently, we sit with about 10% cash, underweight equities, and tilted to shorter-term and typically less risky fixed income. We will notify our clients if we see a need to adjust further. Until then, expect volatility to stay high as headlines grab the market’s attention.