If you follow us on LinkedIn, you will notice our desire to improve our vocabulary through the launch of the Auour Word of the Day (AWOTD). Within this note, you will see demonstrations of our fresh learnings. As with our last note, however, we are going to keep text to a minimum and not perorate (verb; to speak at great length)—oops, we just did.

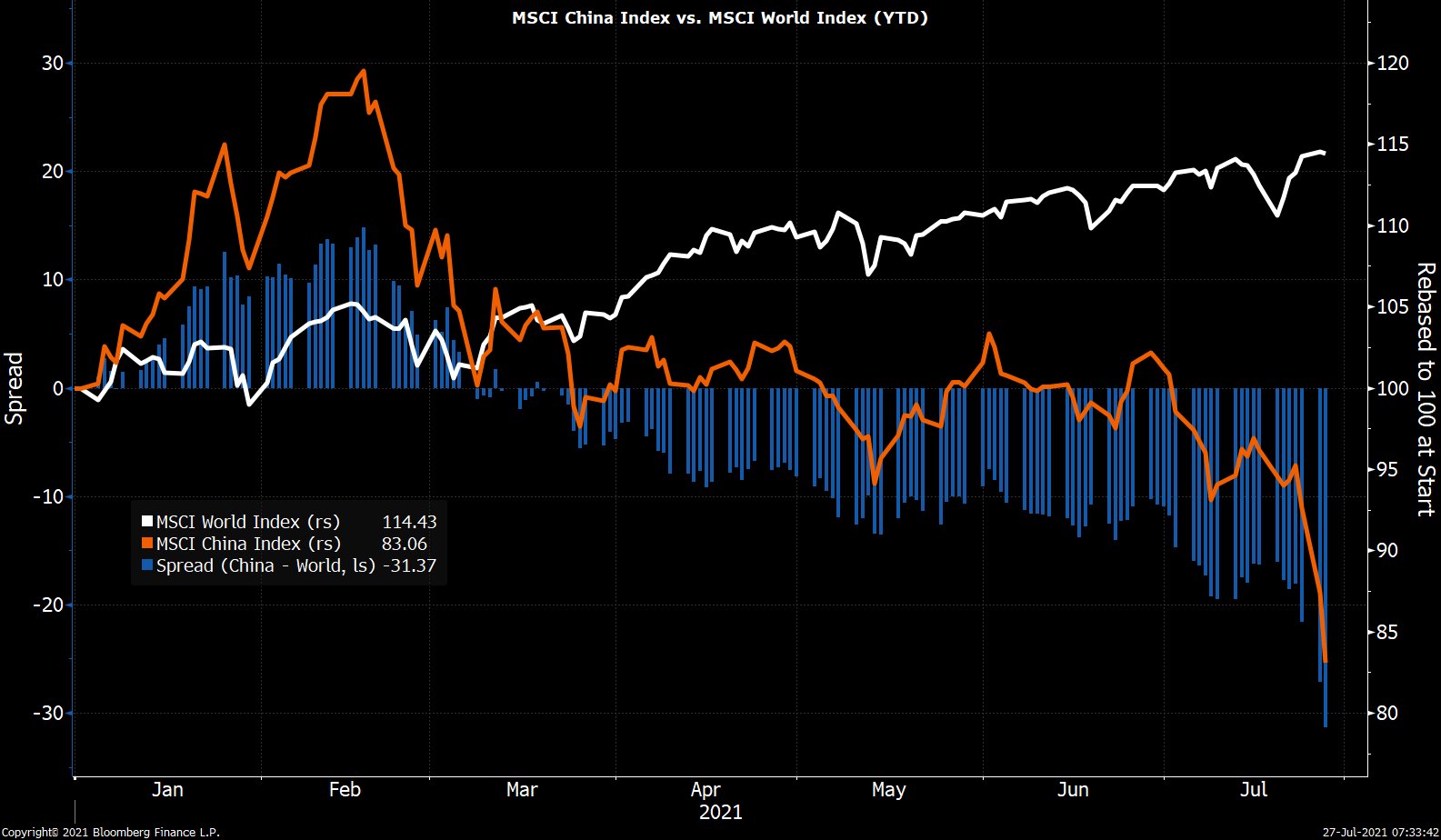

We have repeatedly said we are concerned about the perceived insouciance (adjective; free of concern) of the investment community regarding valuation and growth forecasts. With both equity and fixed income markets priced to perfection, according to historical norms, and optimism in an unperturbed growth outlook, the strong momentum of world markets leaves us not in the carefree camp.

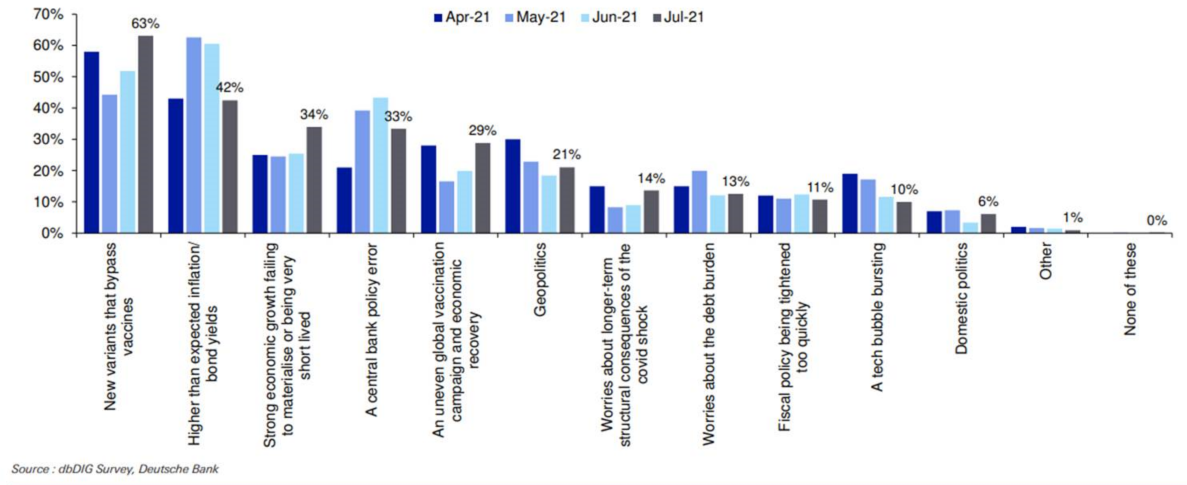

The research group of Deutsche Bank runs a monthly survey of institutional investors, gauging their top concerns. The chart below shows that inflation concerns were prominent in May and June as economies around the world re-opened and supply chains were struggling to keep up with demand. Increased caseloads from the delta-variant became everyone’s chief concern in July, however, as worries revived that we would need to revisit past pandemic protocols. (We hope not because our weight is only now moving back to pre-pandemic levels.)

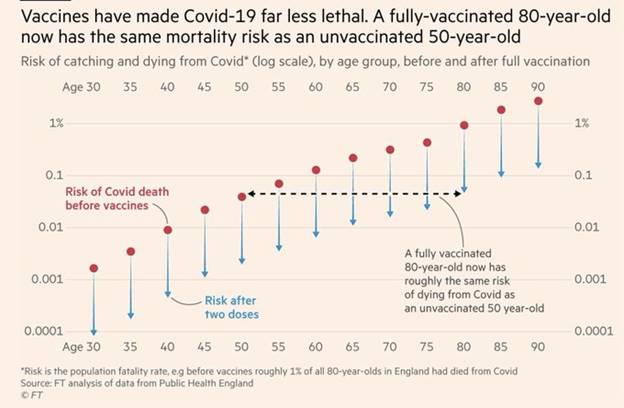

The delta variant appears to be more infectious than the 2020 variants with it too early to understand its severity, leading to concern that our economy’s re-opening process could slow or stall. Thankfully, the vaccines being used in the U.S. and Europe seem to maintain their effectiveness in the face of the delta variant. The chart below is a nice way of seeing just how protective these vaccines, with the risk of dying from Covid dropping by at least an order of magnitude once jabbed.

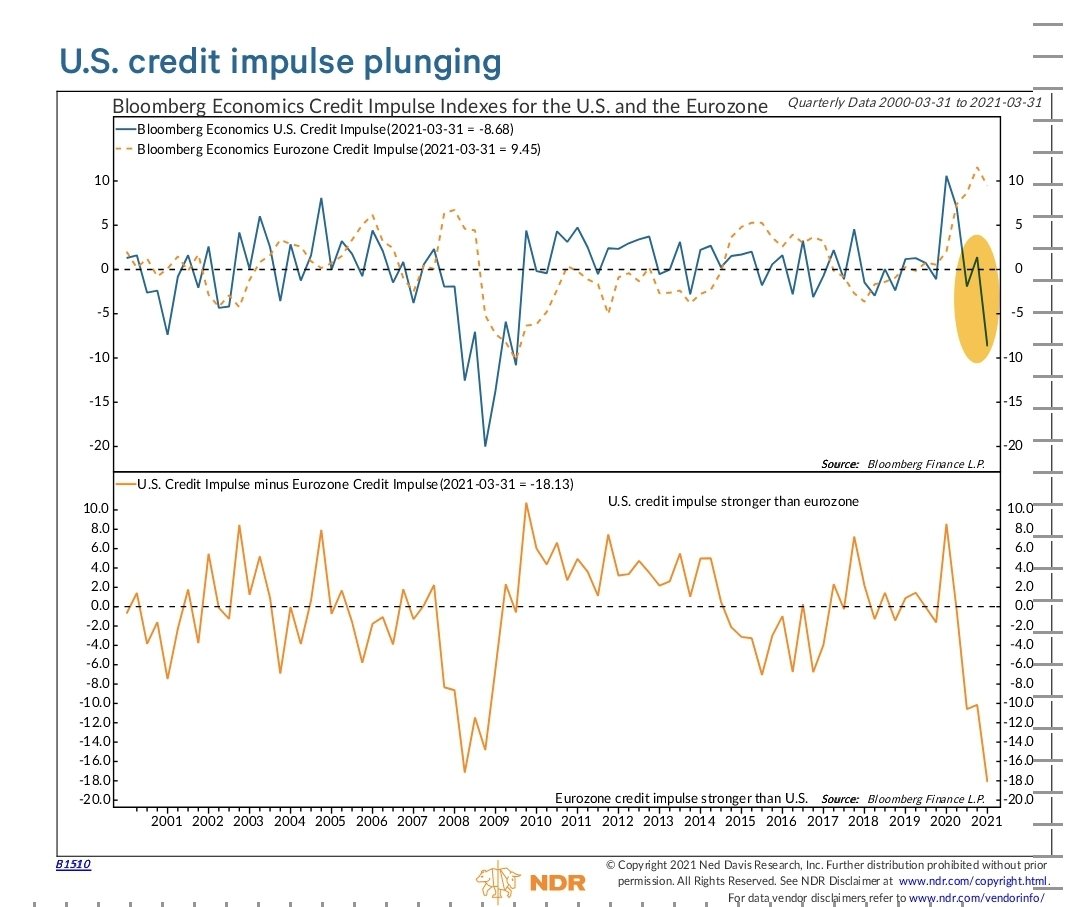

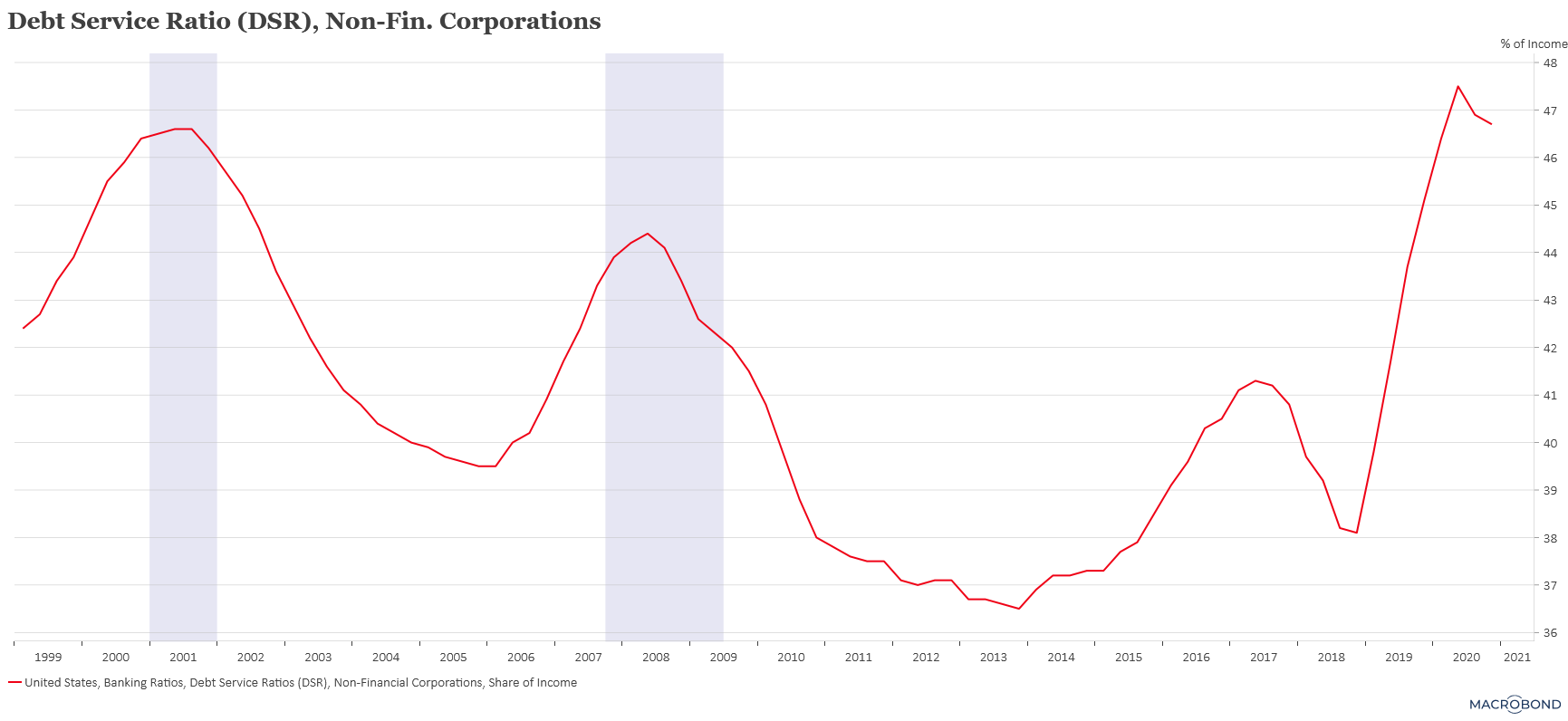

As vaccination rates among adults in most of the developed world reached well above 60%, perambulating (verb; to stroll) without concern was becoming increasingly prevalent. However, the delta variant’s spread has us checking ourselves. And a slowdown in the re-opening process might be a factor in recent drops in several types of financing activity, including credit impulse and corporate debt.

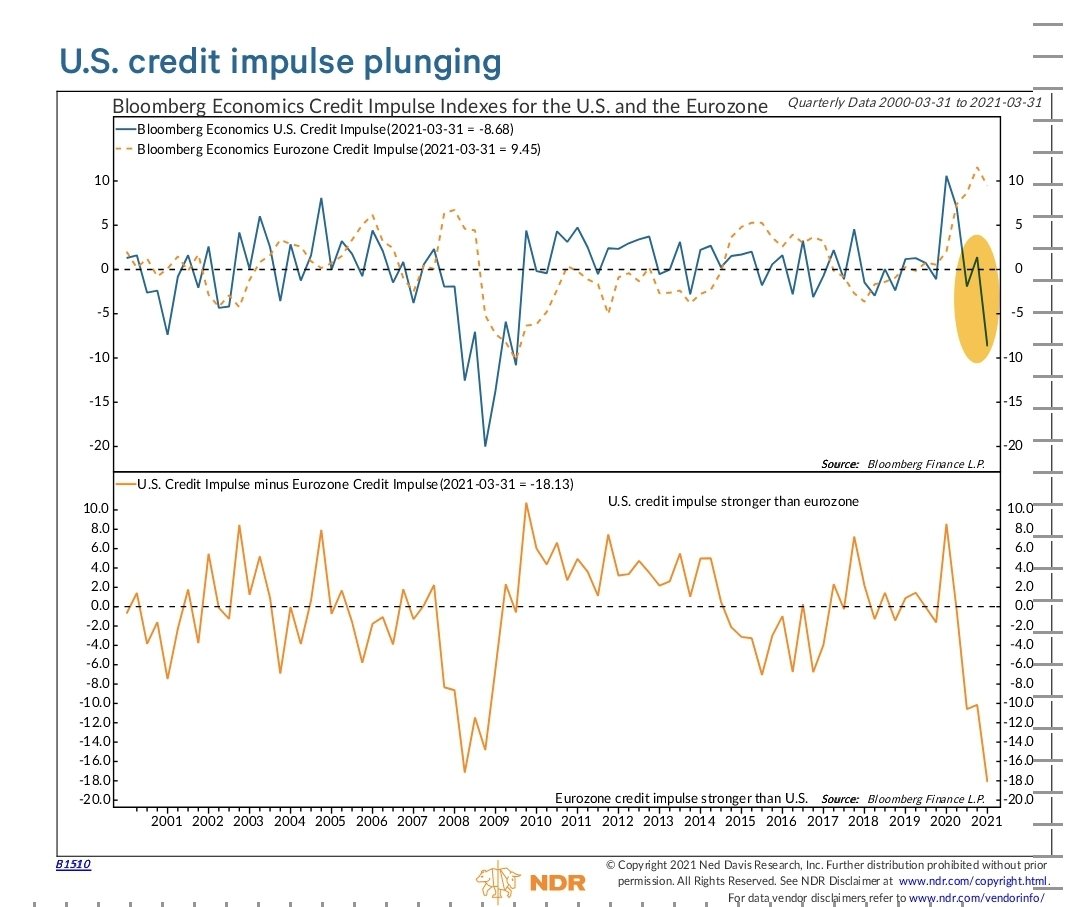

Credit impulse—a measure of financing activity relative to the size of the economy—is showing a worrisome deceleration. We have seen a significant reduction in financing activity in the U.S. and Europe and, most recently, in China. Some of it may be due to the reduction in fiscal stimulus, as well as supply chains getting back to normal. We are monitoring to see if the burst in economic activity is followed by a bust.

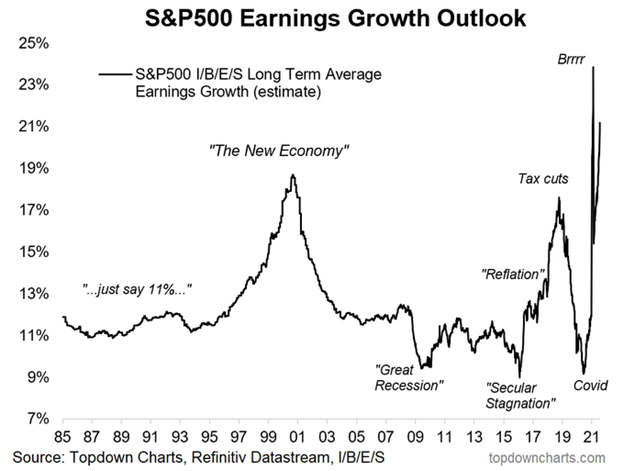

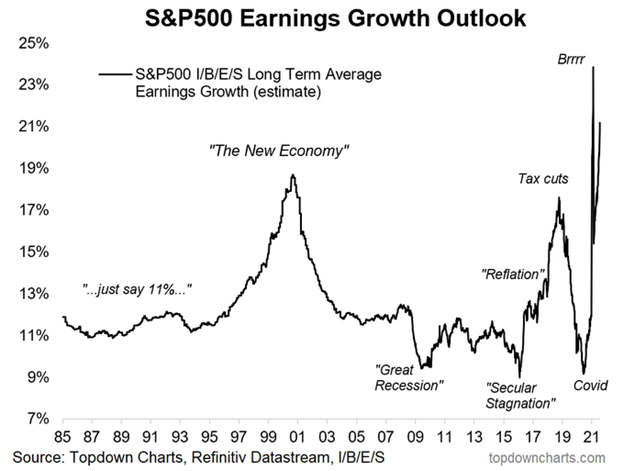

The concerns we at Auour have do not appear to be shared by others; analysts have shared very optimistic updates for the long-term growth of the firms they cover. In fact, the consensus estimate for the average growth of the S&P 500 aggregate earnings stands at over 20% (per year for the next five years). Keep in mind that history has not been kind to the average analyst’s forecasting ability, though. Their estimates track the strength of the equity market, as seen below, rather than predicting the future success of the firms.