From The Perfect Storm

Our investment objective is to produce above-market, risk-adjusted returns—over an investment cycle—at a lower level of experienced risk while mitigating the declines our clients experience over that investment cycle. Over the course of nine years, we have—to date—achieved it. [Past performance does not guarantee future returns.]

Our method is to detect changing risk environments that, based on historical experience, have led to a higher chance of a market downturn. If we are good at this, we can then reposition the portfolio into a defensive position (likely to include holding high levels of cash, a.k.a. dry powder), limiting the pain and allowing for reinvestment later at better prices. That is our aim, not a promise.

Long-term investing is like setting out to sail across the ocean, heading for a destination on the opposite coast. You plan to catch the Westerlies and traverse the Atlantic from west to east. All you need to do is set the sails, grab the wind and be off! Not quite. Storms present themselves throughout the journey, and each time you must choose the path: through the eye of the storm or detour around it. Most investors are told to weather the storm and hope for the best. At Auour, we choose to go around it. You never know how bad it can get; sometimes storms cause shipwrecks.

We started to move around an expected storm a little over one year ago, beginning in December 2021. During the first half of 2022, we turned a bit more away from the storm by raising cash levels in portfolios. In October 2022, we turned back towards the storm, seeing an opportunity. However, that does not assume that we are past the storm completely. Data suggests we might be in a lingering storm that requires further respect and attention as we thread in and out of the storm’s perimeter. We might need patience as we work our way around it. And, of course, it might not be like past storms. (History doesn’t repeat itself so much as it rhymes.)

The last three decades have trained investors to be impatient as market declines were met with accommodative central banks and enhanced government spending. Starting with the Asian currency crisis of 1997, then the turning of the clock to the new millennium, then the Global Financial Crisis, and ending with the pandemic, global authorities in charge of societies’ collective purses have responded with easy money and fiscal stimulus to dampen the pain felt by consumers and investors alike. A typical economic backdrop to those past calamities was a tame inflationary environment, allowing money printing to produce the desired effect without causing (at least noticeably causing) an overheating of the economy.

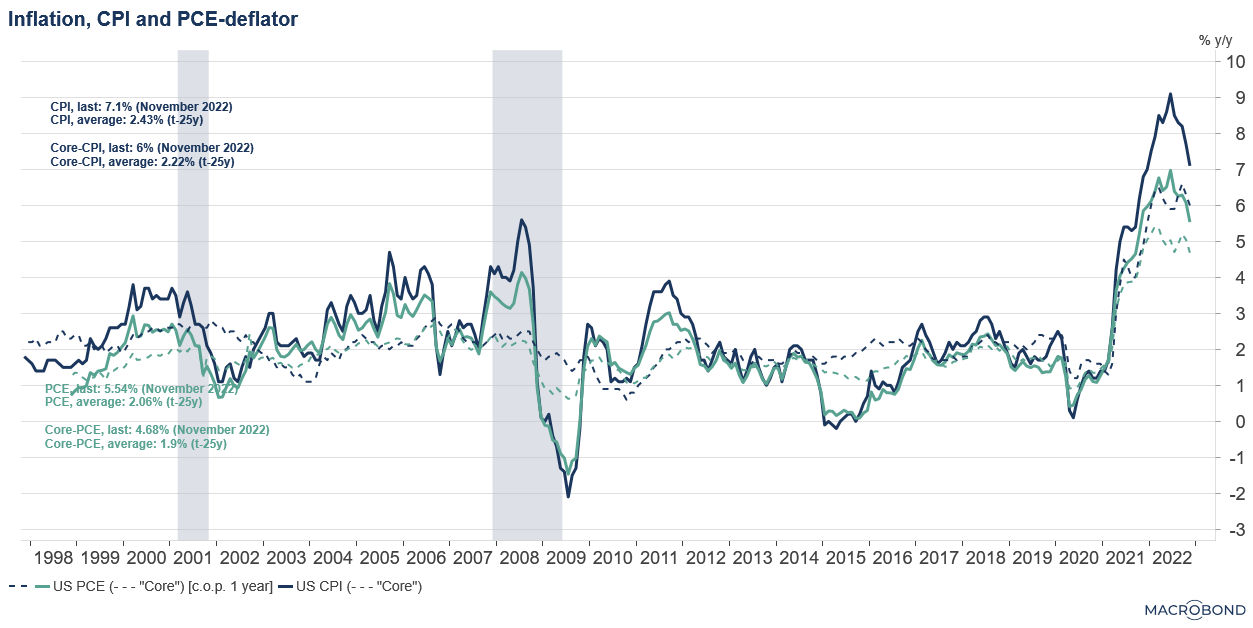

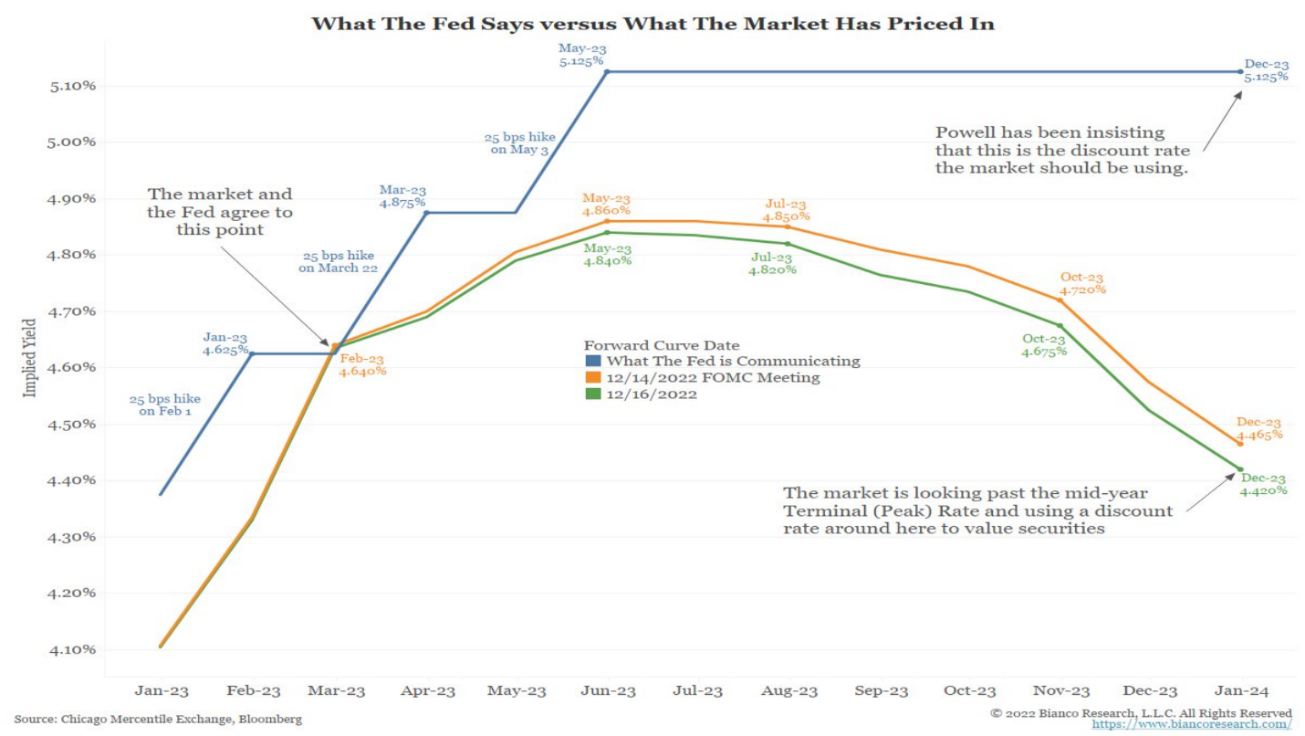

A current concern is that today’s environment could play out differently than in the past two decades. Inflation seems uncomfortably high to the U.S. Federal Reserve Bank, the global provider of dollars. And rather than the Fed coming to the aid of an economic problem, they are now causing it because they see excess demand as the inflationary culprit. Stating it differently, central banks came in during past economic slowdowns to spur demand through easy money. Now? They aim to shrink demand by draining money from the system if they think inflation stays uncomfortably high.

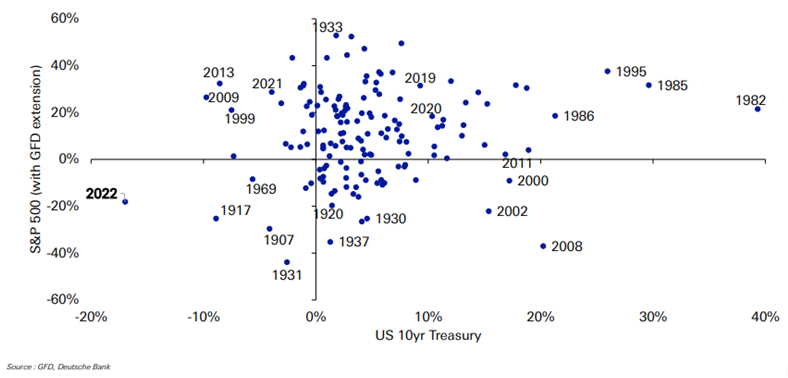

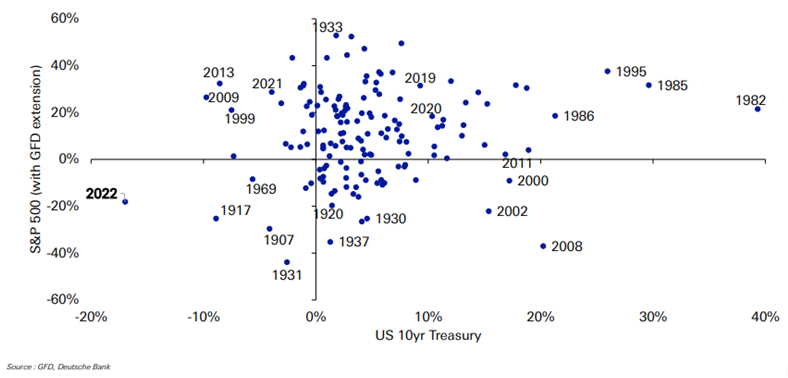

We do not want to spend much time revisiting 2022, apart from sharing the above chart that painfully sums up the year in context, showing the annual returns for equities and fixed income indices by calendar year. 2022 was a horrible year with little resemblance to past experiences. It was a perfect storm in which elevated valuations, overconfidence in growth, and cheap money collided.

As we look to the rest of 2023 and beyond, we highlight a few important questions for understanding the path forward and the potential lingering impacts of the current storm.

- Did the response to the pandemic by central banks mitigate the importance of yield-curve monitoring?

- Is CEO sentiment an important indicator for labor markets and economic activity?

- Is the inflation we are experiencing controllable with neutral interest rates?

- Is there a structural element to inflation that has yet to be discussed or addressed?

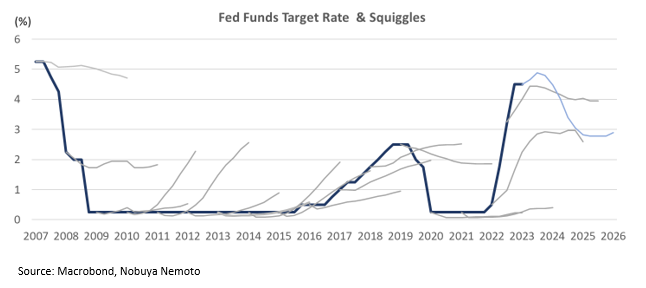

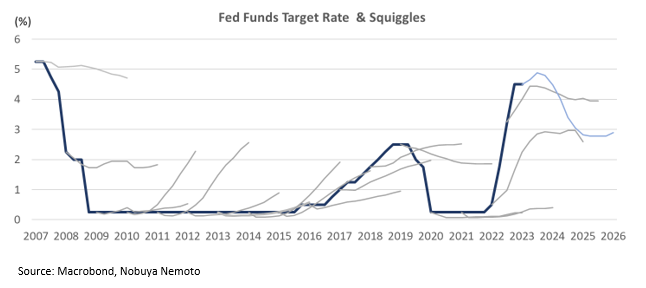

- Can global economies move back to an easy money environment that existed for the past two decades, or do we need to adjust to a more expensive and tighter monetary system?

- Does history repeat with the next bull market having a new leader? If so, what should we be looking at?

- Will the conversations decisively turn to corporate earnings from inflation?

Let’s take each one individually.

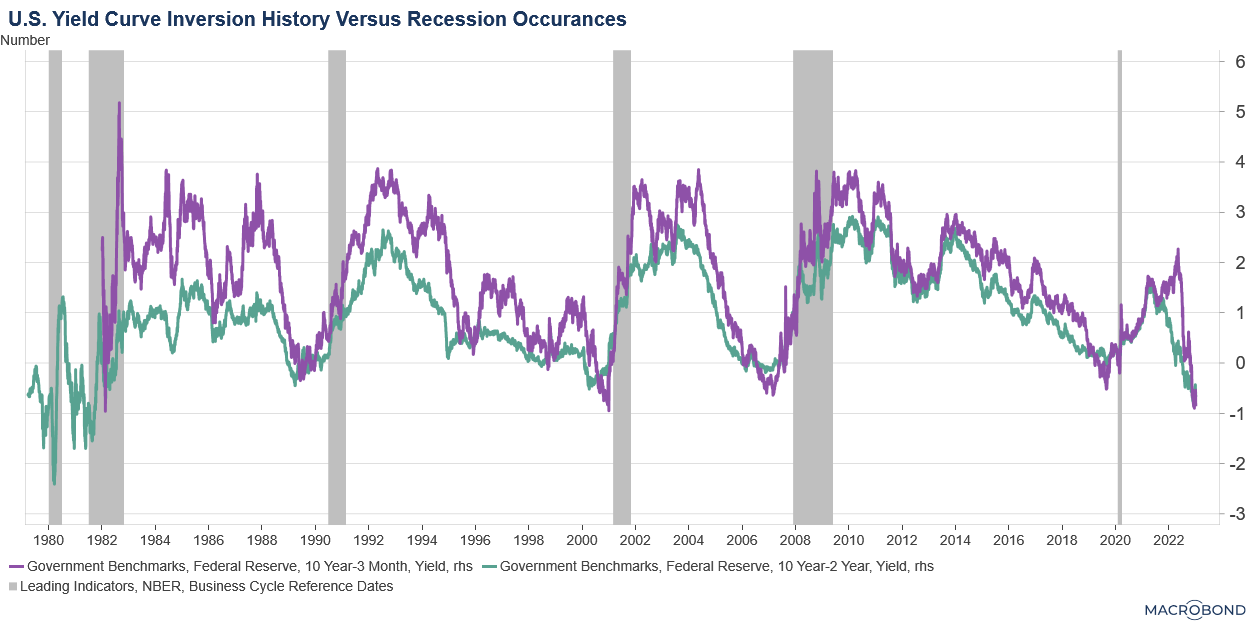

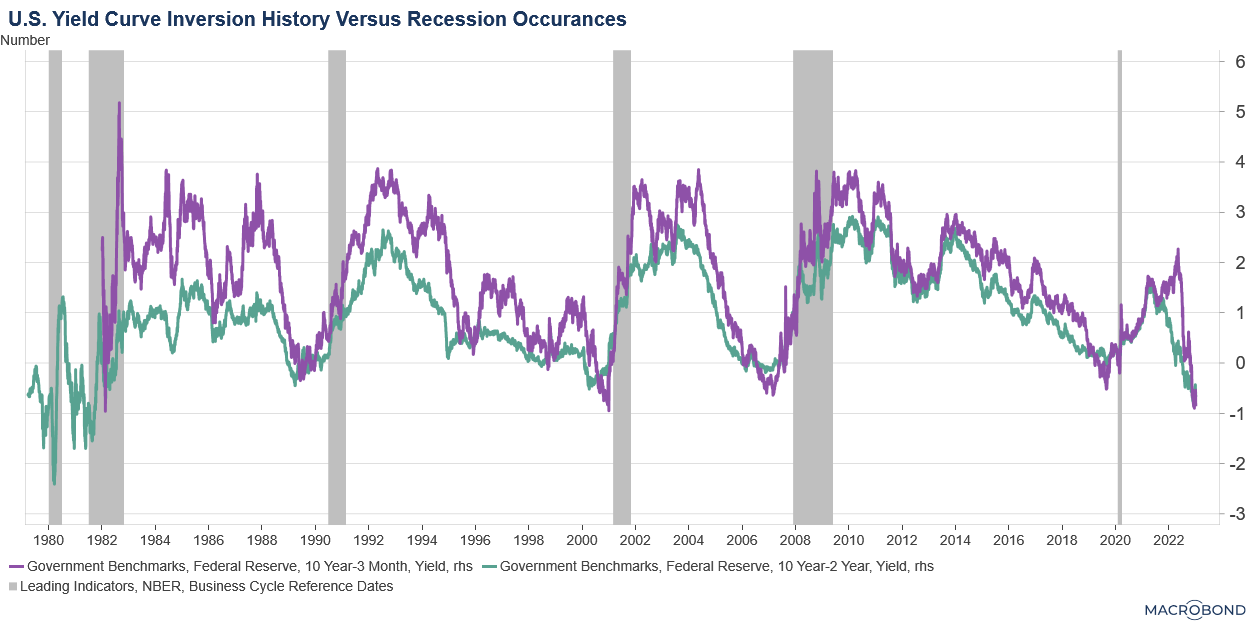

1. Did the response to the pandemic by central banks mitigate the importance of yield-curve monitoring?

The time between when inversion occurs and when a recession (in hindsight) starts has varied considerably throughout history. In some cases, it was as short a period as six months. In other cases, it took multiple years. On average, it has been about 18 months. The yield curve inverted in the summer of 2022, suggesting a recession starting mid to late 2023. Some argue that it could begin sooner, given the aggressive rate increases we have experienced as we came off the zero bound. Others suggest that moving from a zero-rate level neutralizes the importance of inversion, which, from our perspective, is a this-time-is-different argument. Given the historical significance of this signal, we stand closer to believing that no matter why it happened, the fact that the yield curve did invert is an important signal.

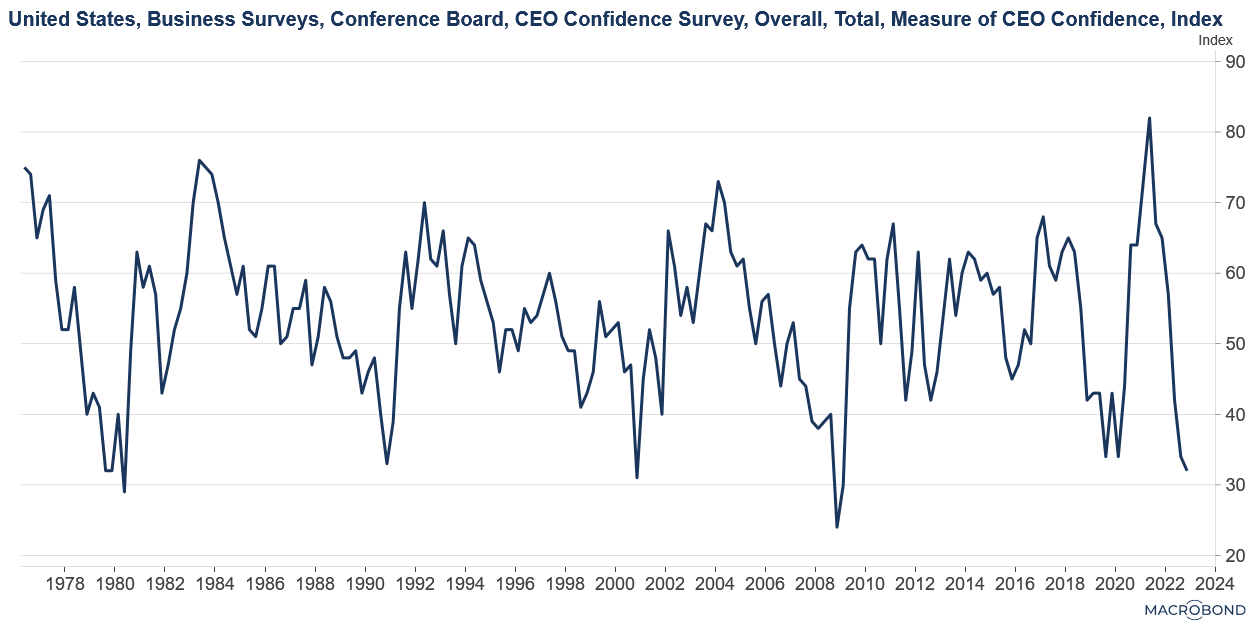

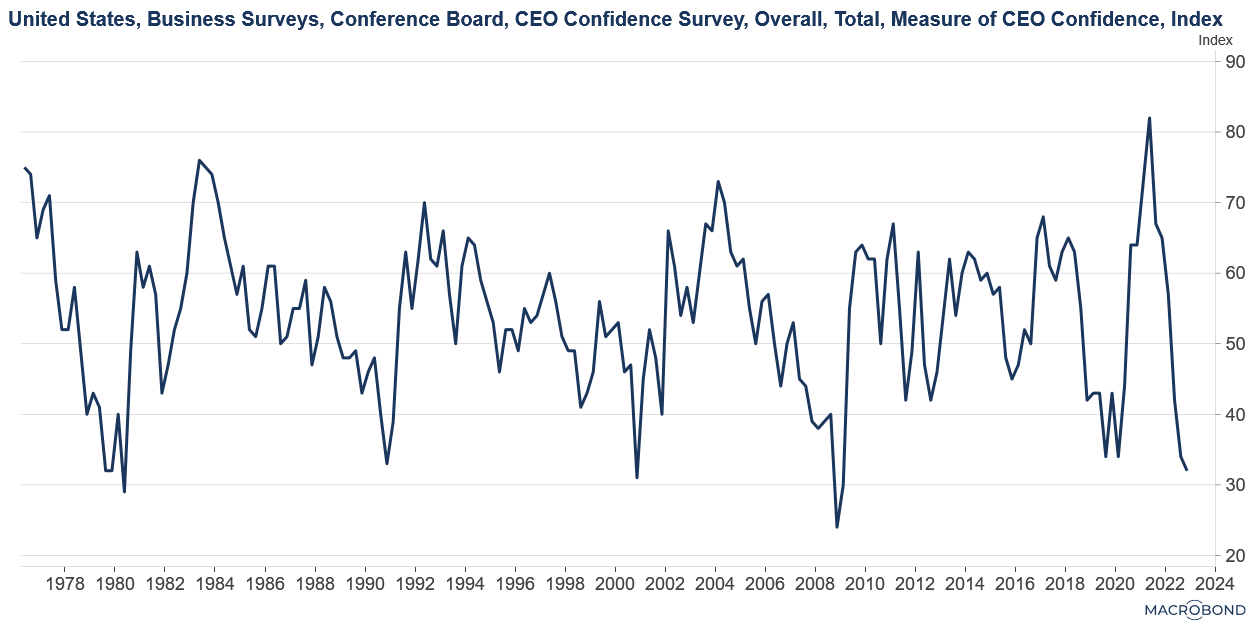

2. Is CEO sentiment an important indicator for labor markets and economic activity?

As of this writing, CEOs are not showing confidence. Recent survey results are near the worst experienced. Past periods of lack-of-confidence have led to or coincided with softening labor markets and periods of slow or negative growth. In addition, leading companies within the technology sector have been making headlines with their notable layoffs. It should be mentioned that the confidence of CEOs is volatile and came off extreme exuberance in late 2021. Are the current negative feelings driven by a reflexive move from past exuberance, or is something more amiss? It is important to watch this metric for clues on the

3. Is the inflation we are experiencing controllable with neutral interest rates?

4. Is there a structural element to inflation that has yet to be discussed or addressed?

The global community is changing the “faster, cheaper, better” mantra to “faster, cheaper, better, less harmful.” Concerns that we humans are harming the environment are taking center stage as concerns also grow about the exploitation of slave labor within regions of China. Add to that the growing skepticism around supply dependency on China, and one can see significant investment is being diverted to changing the manufacturing of current output. These significant investments are not expected to bring about lower-cost products or added demand—in many cases, the products cost more.

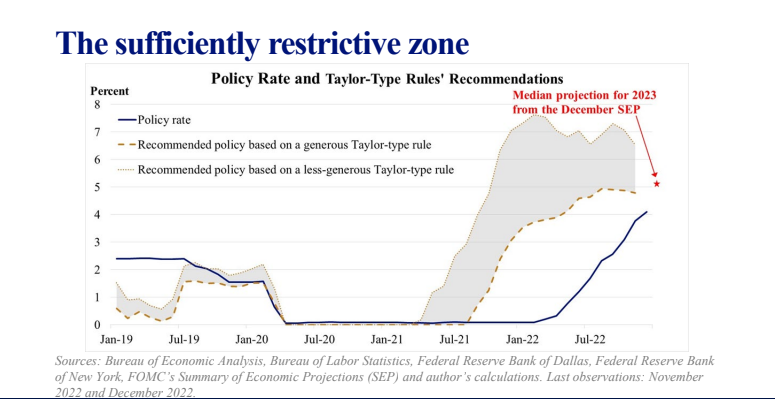

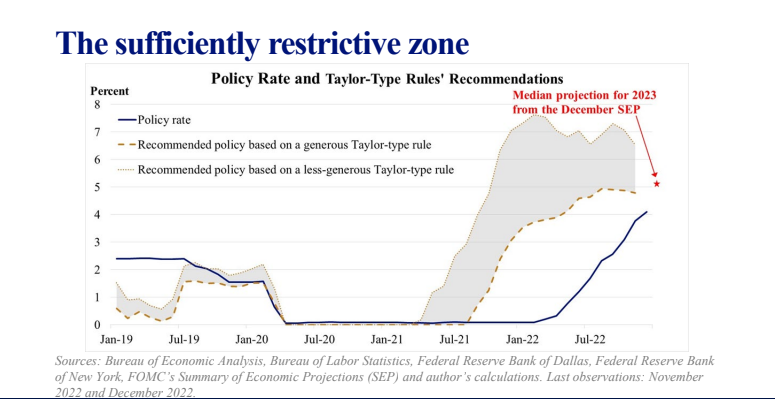

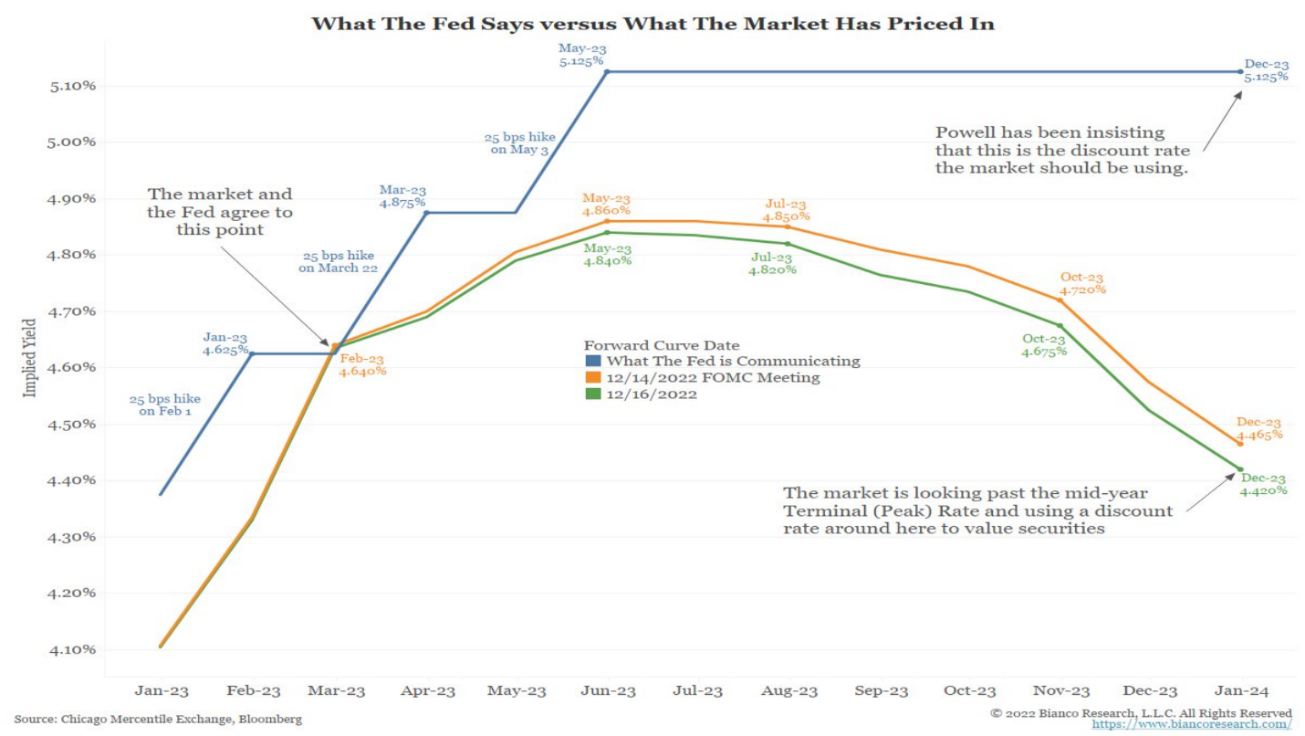

There is a large discrepancy between the Fed’s view of the future cost of money and what investors think. The chart above highlights the expectations of the Fed on future interest rates (blue) and investors’ expectations (green and orange).

We don’t have a strong opinion (we have an opinion, just not a strong one) other than wanting to respect the fight between the two rate makers at present. We see the discrepancy bringing about high levels of uncertainty. Asset prices are very dependent on interest rates. With the current disparity in rate expectations, one should assume asset pricing will be more volatile than average.

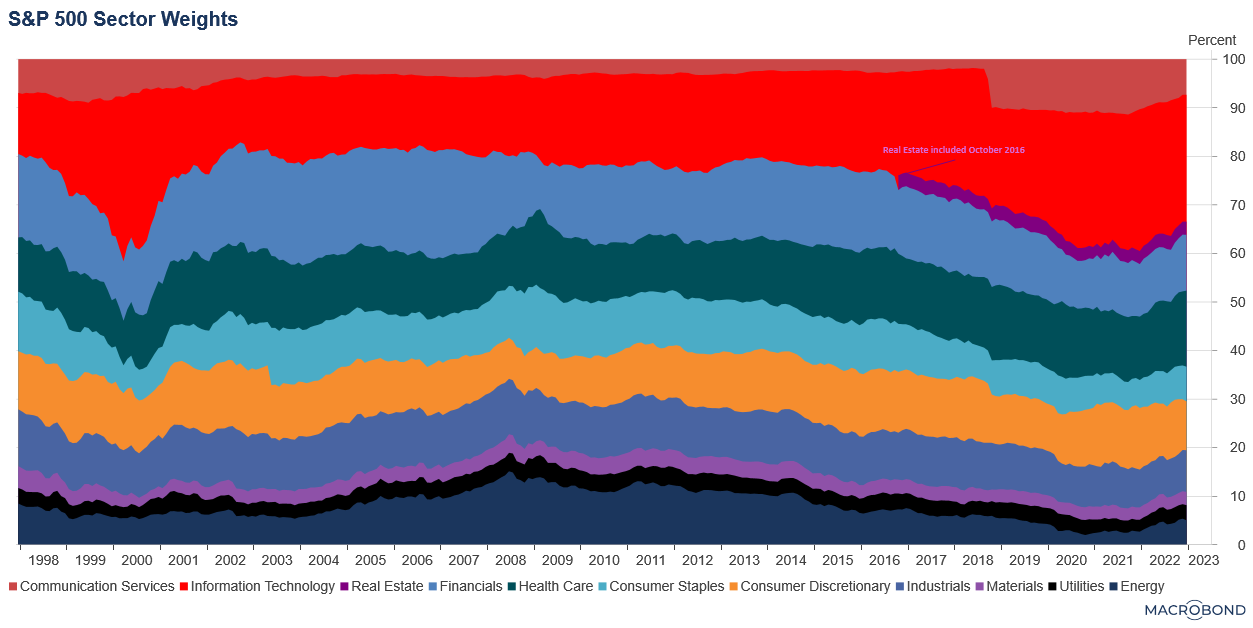

6. Does history repeat with the next bull market having a new leader? If so, what should we be looking at?

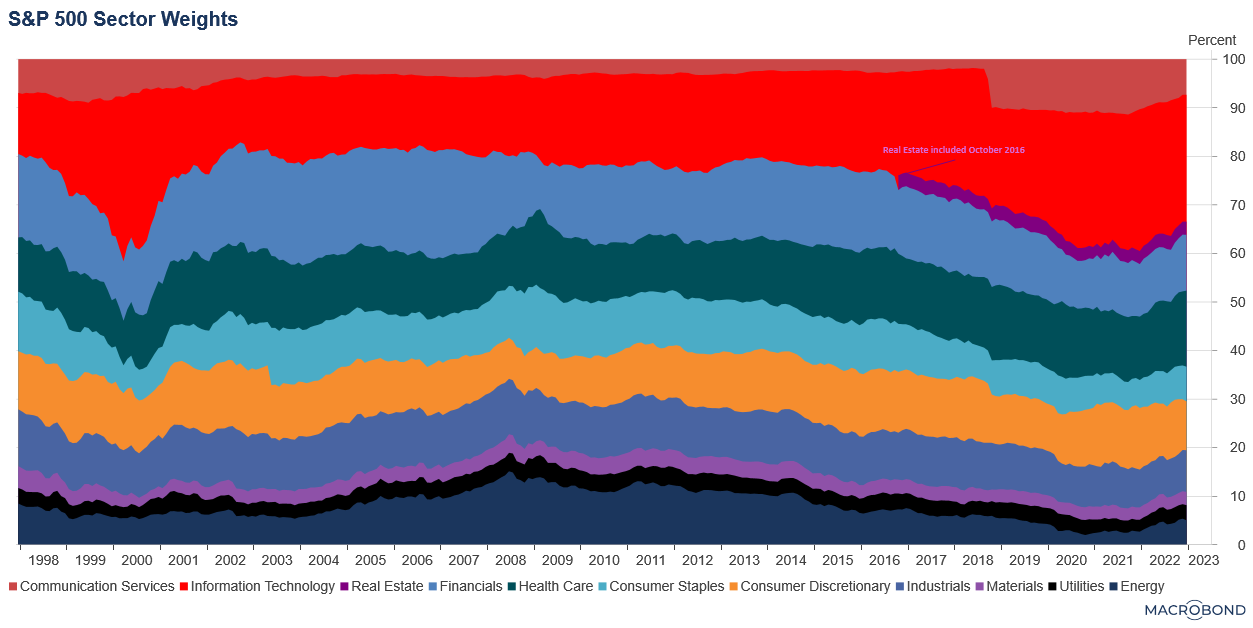

Historical market recoveries from bear markets have been consistent in that the leader of the past bull market always lags within the new bull market. For example, the technology sector led in the bull market that ended in 2000, and it then lagged as the energy and financial sectors reaped the rewards of the next bull market. The last decade of market gains again showed technology companies being favored, with the sector’s weight within the S&P500 index reaching almost the same magnitude as in 2000.

7. Will the conversations turn decisively to corporate earnings from inflation?

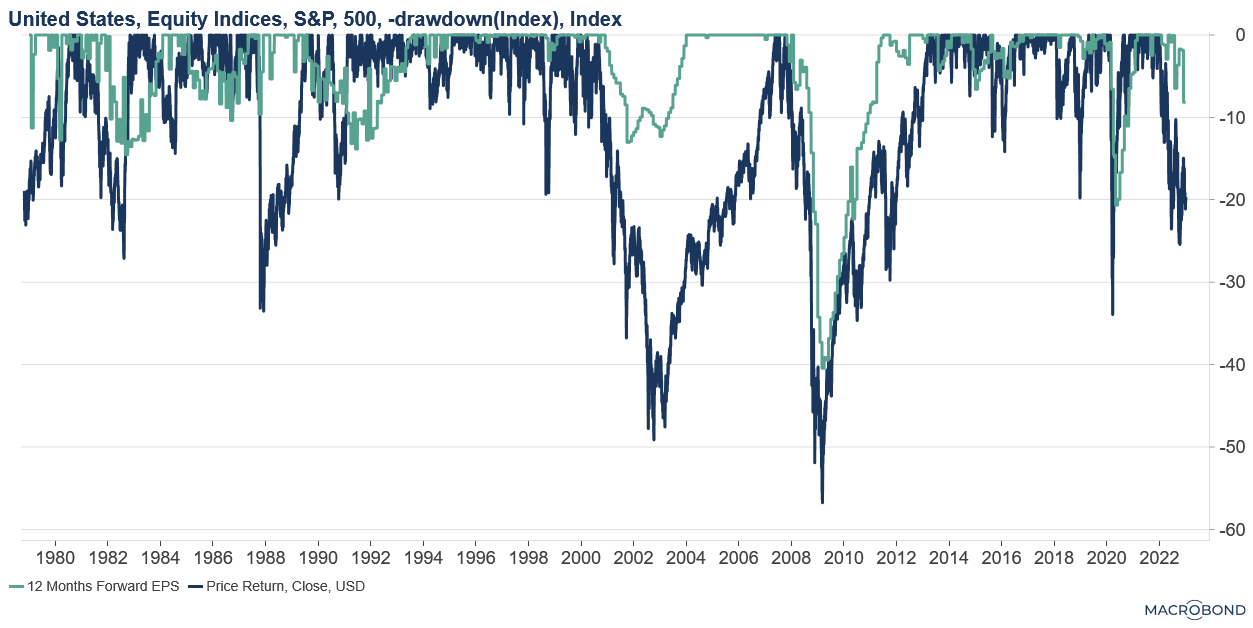

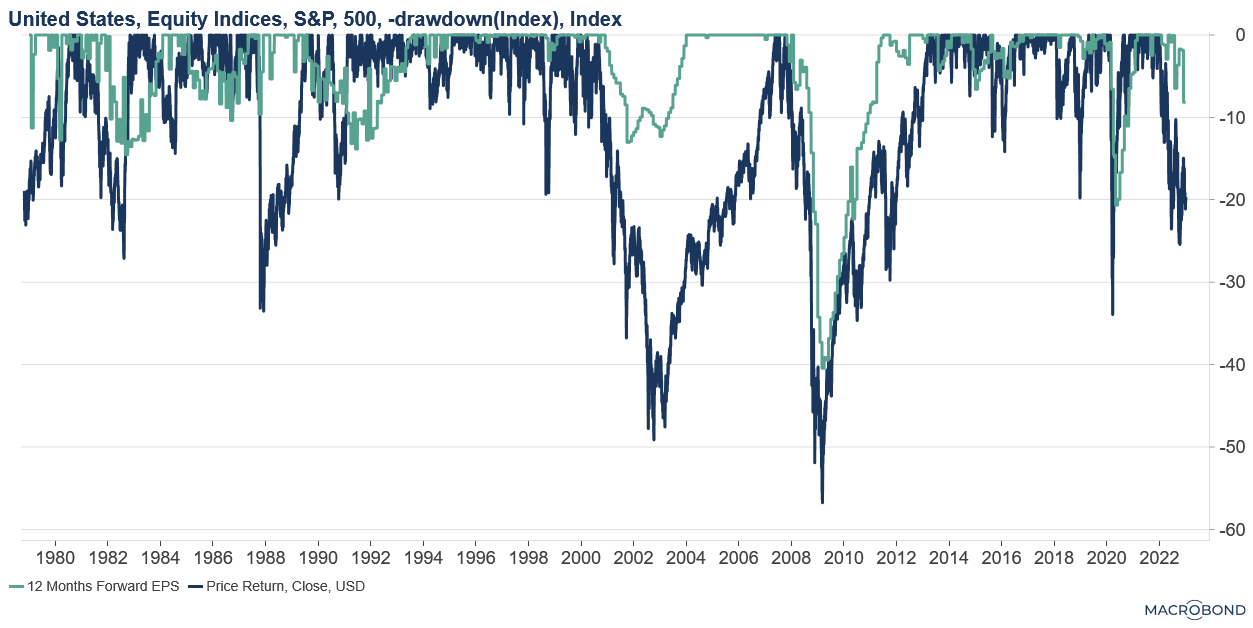

Much of the financial discussion today revolves around inflation, and this newsletter is no different. It begs the question, are we looking in the wrong direction? Not really. Many are focused on if and/or when a recession comes about to help predict the future of corporate profits, which are a material driver of stock prices.

Inflation is the problem, and the Fed thinks a recession is probably the answer. Investors around the globe are accustomed to central banks dissipating economic softness. This time, the central banks are guiding the eye of the storm directly at the economy as they fight inflation.

Recessions are normal, even if painful. We believe we are in the bottoming process right now. The good news is that health in the labor market is likely to soften the blow, so maybe we will see a reset in growth expectations rather than a reset in operating norms. But even soft landings have a thump.