Prescribed Fire

White oaks are large, deciduous trees native to eastern North America. The wood from the white oak is highly valued for its strength, durability, and resistance to decay and insect damage. It is also appreciated for its lack of porosity, making it vital to the spirits industry, which ages bourbon in oak barrels for decades. For a spirit to be labeled a bourbon, it must, by law, be aged within a new, charred white oak barrel, creating an ongoing need for a stable supply of new barrels. The cooperage business is highly secretive, so annual barrel production numbers are not disclosed. However, as of 2020, the Kentucky Distillers’ Association estimated that close to 11 million barrels were in use within the state.

Stay with us. A recent episode of Bloomberg’s Odd Lots podcast discusses how the white oak population is expected to decline by 70% over the next four decades unless we address the issue now. It may seem like a problem that can wait, but you must plant and protect the seedlings to have a mature tree in 40 years. The issue is so significant that the bourbon industry has joined forces with forestry services and other stakeholders in forming the White Oak Initiative (WOI). It aims to stem the decline in young trees to sustain a healthy ecosystem.

The WOI produced a report addressing the implications of the long-term loss of white oak trees and provides a plan for combatting the underlying causes of the declining population. One of the more prominent action items: to allow prescribed fires within the forests. In past newsletters, we have mentioned how new forestry strategies in the West involve reversing past practices and starting the use of small, controlled forest fires to reduce the likelihood of large, uncontrollable fires. The small fires remove stored energy in the form of leaves and brush from the forest floor. The white oak plan is based on the same concept. Its powerful root system allows the tree to survive a small fire while the fire removes competing species with weaker root systems.

Are the investment markets so boring that Auour is turning its attention to forestry? No, reader, far from it (although our interest in bourbon as it relates to quality of life is not insubstantial). Listening to this podcast, reading the WOI’s plan, and perusing the web for fun facts about bourbon, the cooperage industry, and trees did have an investment purpose: to find the right analogy for the current investment environment.

The Federal Reserve is walking a tightrope as it works to fight inflation by slowing the economy… but not too much such that it causes significant economic disruption. We appreciate that the Fed’s dual mandate (i.e., protecting the currency’s value and maintaining full employment) has put it in this challenging position. However, its actions to prevent economic turbulence before it starts are no different from past heavy-handed forestry practices of squelching any spark that flies toward a forest. Those good intentions to fight any and all fires resulted in a growing instability in North American forests.

The Purchasing Power of Money

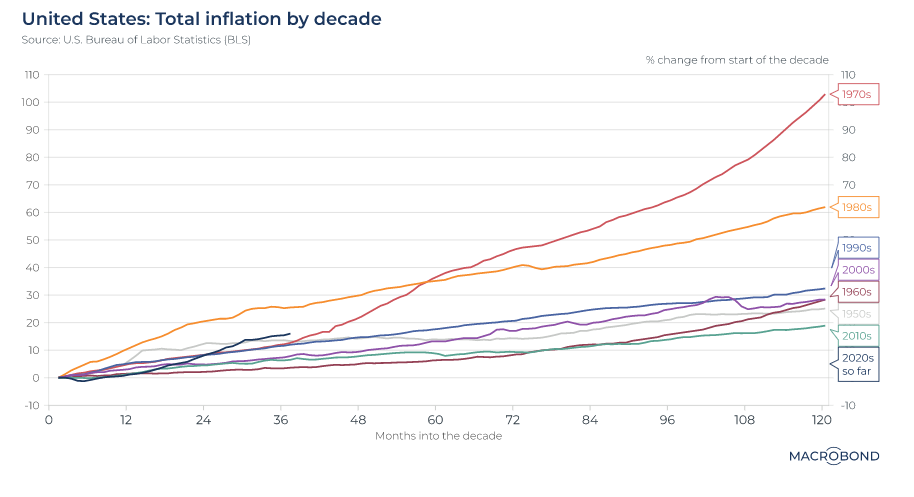

Let’s start with an overarching question: Why do we invest? The answer is to maintain and grow the purchasing power of our savings. We love a Big Mac and want our savings to enable us to afford them in 10, 20, and 30 years in the same manner we can afford them today or better. In other words, we want ten dollars of our savings to purchase the same, if not more, in the future as it can today.

And the biggest hurdle to maintaining purchasing power is inflation.

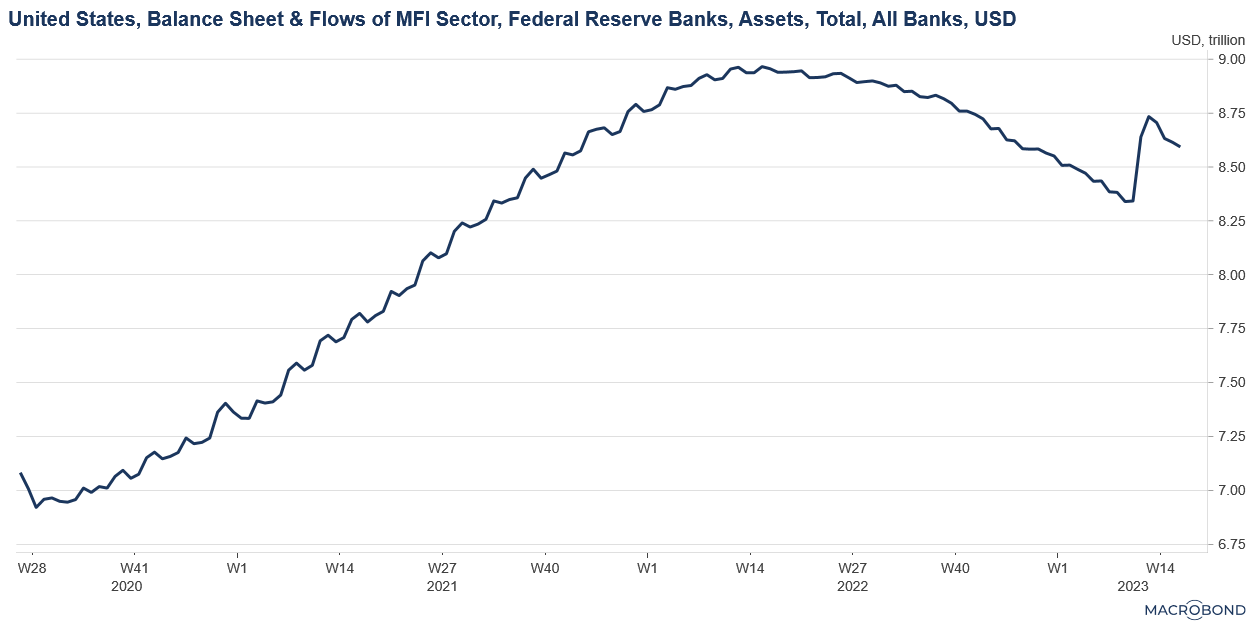

With the aggressive and determined steps the Federal Reserve has taken since March 2022, we thought the conversation in 2023 would turn to concerns around corporate profits as inflation trended through the year toward the long-term target. The collapse of a few large regional banks initially reinforced our belief that those events would quicken a credit cycle, bringing about an earnings recession and adding confidence that inflationary pressures would subside. This seemed like an unintended, yet effective, prescribed fire, localized to a few regional banks.

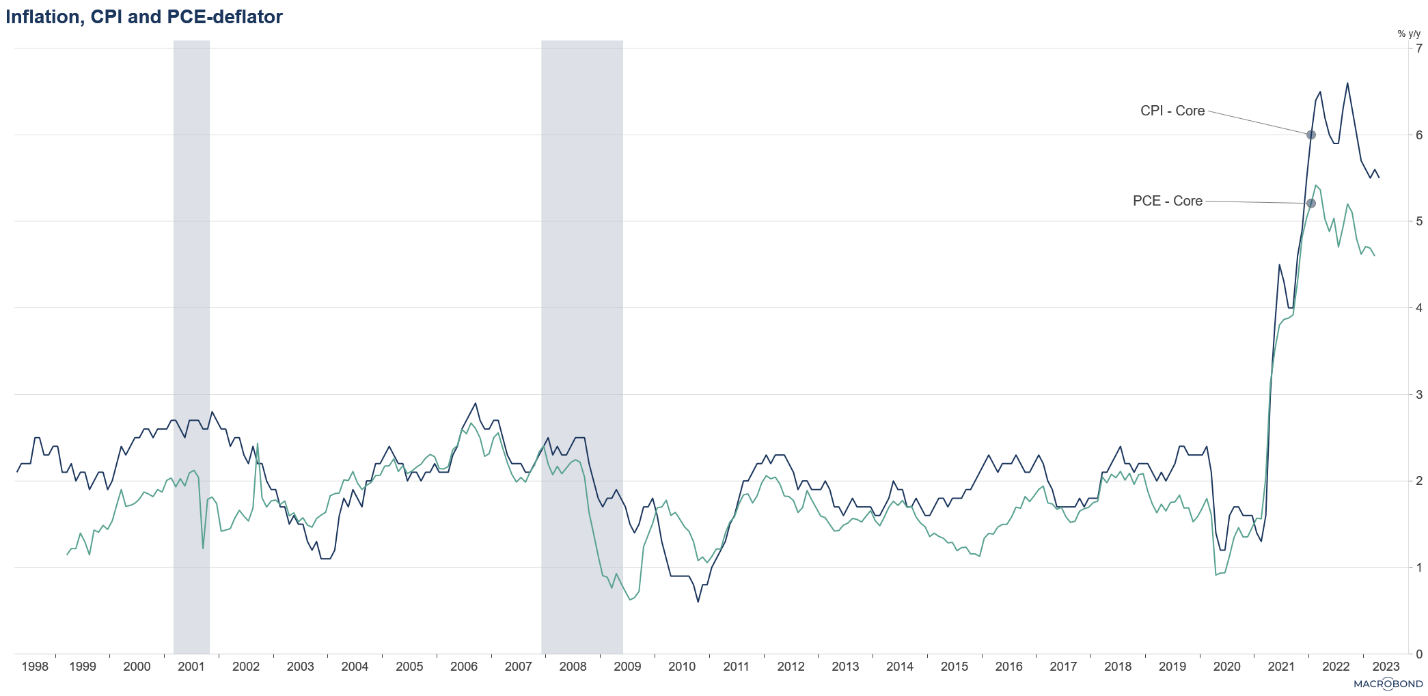

But recent inflation readings have not suggested it is quickly moving toward the desired 2% level. And the Federal Reserve governors have been making statements that they may pause to see the impact of past rate rises and the expected restrictive banking behavior.

The government and Federal Reserve’s response to the current banking situation gave many the impression that these institutions blinked. Over the past twelve months, as interest rates have increased, the fixed-income markets consistently expected the high rates would be temporary, and they priced in lower rates starting mid-year 2023. The fixed-income markets did not believe the Fed would keep rates high, even though that was the message from the Fed. Well, words are one thing, and actions are another. And the Fed’s recent indications of a pause in further rate increases favor the fixed-income market being right versus the Fed.

From our seats, the Fed’s credibility is severely jeopardized. It says it wants to reduce liquidity in the system to slow inflation, while its most recent action was to throw more money into the system.

Coinciding with the Fed’s noticeable reluctance to fan the flames brought on by the bank failures and maybe a bit less willingness to fight inflation, we are hearing more people suggest that slightly hotter inflation is not something to fear.

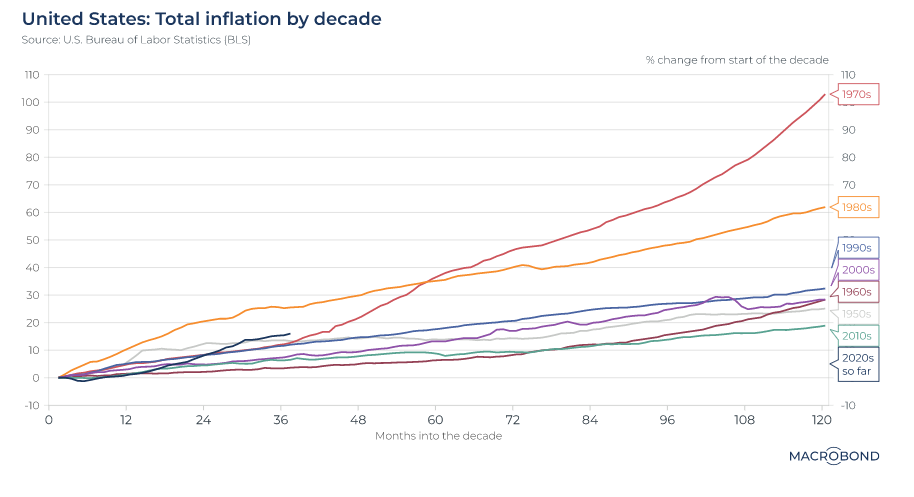

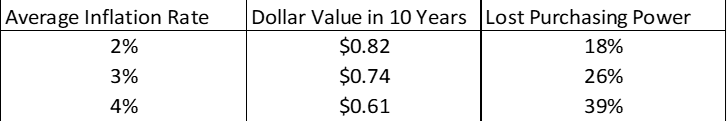

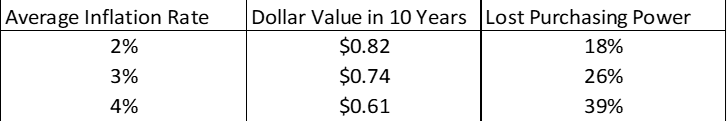

Inflation of 2%, 3%, or 4%? What’s the big difference if inflation stays higher for longer? The numbers are small.

The table above helps to show what small differences in inflation rates can do to the purchasing power of a currency. A one or two-percent difference sounds small, but it isn’t. As the table demonstrates, the difference between an average 2% inflation and a 4% inflation rate over ten years can result in a further 20% decline in purchasing power. So the Big Mac got a lot more expensive.

Fed chairman Jerome Powell has stated that he wants to be the Volcker (the Federal Reserve chairman who strongly broke the back of inflation focused on protecting the dollar’s power), not the Burns (the Federal Reserve chairman who blinked in the early 1970s). Powell’s actions started strong, like Burns, but now comes the test of his resolve to protect the currency at the risk of economic softness. Volcker has repeatedly stated that his overall mission was to protect the dollar’s reputation. Powell seems more focused on protecting the reputation of the banking sector—two very different things.

If it isn’t clear yet, we worry that the Fed is losing its resolve to fight inflation. They can’t seem to let prescribed fires burn, potentially increasing the instability within the ecosystem. We do not advocate for a scorched earth policy. Still, we believe that economic turbulence is a necessary evil that exposes the weak companies and strengthens the surviving ones (usually those with a better business model and prudent management), leading to a more stable and durable environment. Like White Oaks.

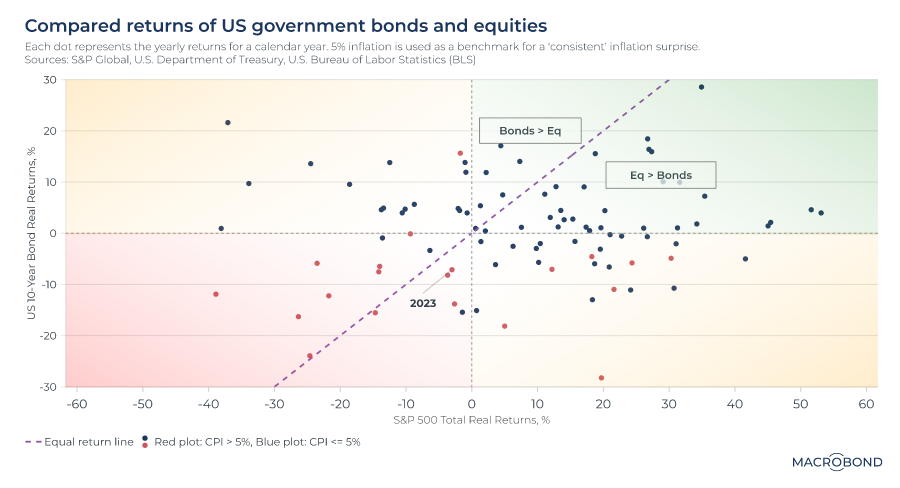

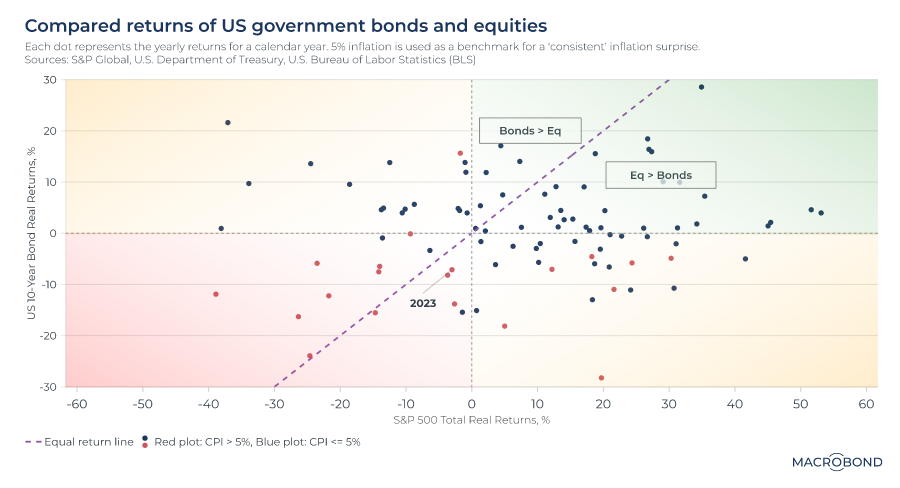

So, if we are facing a period of a weak Fed and stubborn inflation, how do we look to, at a minimum, protect purchasing power? Equities have shown resilience throughout time, though not for the faint of heart. The graphic below plots the yearly returns of the fixed-income class (using the 10-year Treasury bond as a proxy) versus the equity market annual return (as measured by the S&P 500 Index). With all the caveats that past performance may not translate to future returns, the chart below tells a story. Years in which inflation ran above 5% are depicted in red, while those below 5% are in blue. Focusing only on the red dots, there is only one instance where bonds had a positive real (after inflation) return. For equities, seven out of twenty produced positive real returns. Not great odds. Of those thirteen years producing negative returns, roughly half produced a greater than 10% decline. Obviously, the future can and will be different, but history should be respected.

Here comes the sales pitch. Those periods of inflation had periods of good equity returns and periods that were bad. Suffering that turbulence can make one think they are winning against the fire and then quickly change to fearing they are trapped by it. This, we believe, argues for a dynamic approach to equity investing. We, coincidentally, offer a dynamic approach to investing.

Given the shifting winds, we expect this year to be more dynamic than most. Over the course of this year, we have moved more into equities, first desiring large U.S. exposure and recently moving more into U.S. mid and small-cap and international equities. We continue to carry a more defensive posture in the fixed income investments, seeing no need to wander far from short-duration investments with higher income production.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk, including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.