Dollar Dominance

The media often plays up the narrative that the U.S. dollar is about to lose its dominance. We can understand investors’ fear but cannot find an argument that warrants the decline in dollar power. We could find reasons to think the dollar may lose some value relative to others but to lose its status as the world’s reserve currency seems hard to justify.

The interesting thing about currencies is that for one to lose, some other one needs to win. So, for all the concerns about the U.S. dollar, one needs to be able to find another currency (or set of currencies) that allay those concerns—no easy feat from our standpoint.

We wanted to have some fun, so we asked ChatGPT to help us write this newsletter. We asked it to write a dialogue between a salesman and a prospective client where the salesman wants the prospect to commit to using the dollar as its reserve currency. The conversation is displayed below. Within it, we will add our thoughts (in blue), either agreeing or disagreeing with ChatGPT.

Note: we have not adjusted ChatGPT’s dialogue at all.

Salesperson: “Greetings! I’m here on behalf of the US Dollar, the primary reserve currency of our world.”

Prospect: “Hello. I’ve been contemplating a shift to the Euro, Yen, or possibly even the Renminbi. Can you persuade me otherwise?”

Salesperson: “I’d be happy to! Let’s begin with stability. The US Dollar is grounded in a resilient economy – one of the most diverse and robust globally. But the strength of the Dollar is not only in the economy but also in the rule of law that governs the United States.”

- Economic resiliency comes in many forms. One way is to measure import/export activity as a percentage of total GDP. The lower the number, the more economically independent the country. The U.S. is resilient in this measure as global trade accounts for approximately a quarter of total GDP. Japan and China are over a third of their economy, and European countries (individually) are in the 50% range.

- Another resiliency measure would be core commodity production to satisfy internal needs. The U.S. is the largest oil producer, with enough to be recognized as a net exporter, and the second largest grain and protein producer, contributing about 20% of the world’s supply.

- And since the salesperson brought up the Rule of Law, the U.S. sits in the same position as European countries and Japan from the governance standpoint. The only way to see this as differentiation is the military power that backs up the U.S. relative to its peers.

Prospect: “That’s a fair point. But what about the Euro? The European Union is quite an economic powerhouse, too.”

Salesperson: “Indeed, the EU is an influential player. However, it comprises multiple countries, each with their unique economic issues. The US Dollar, conversely, is supported by a single, unified economy, fostering predictable and sound monetary policy, all under the umbrella of a strong legal framework.”

- With currencies tied to countries, the perceived value of a currency will be driven in part by the government’s taxing authority backing it. The E.U. has not reached the point where one government has the power to tax. And that each country within the E.U. still has its own central bank adds complexity to currency stability.

Prospect: “The Renminbi’s growth seems promising, though. China is the second-largest economy in the world. And Japan’s Yen has long been a pillar of stability.”

Salesperson: “True, but liquidity and convertibility are crucial considerations for a reserve currency. The US Dollar, being the most widely traded currency, provides unmatched liquidity and ease of conversion worldwide. The Renminbi, while growing, is still heavily regulated, limiting its convertibility. The Yen, despite its stability, lacks the widespread global acceptance that the Dollar enjoys.”

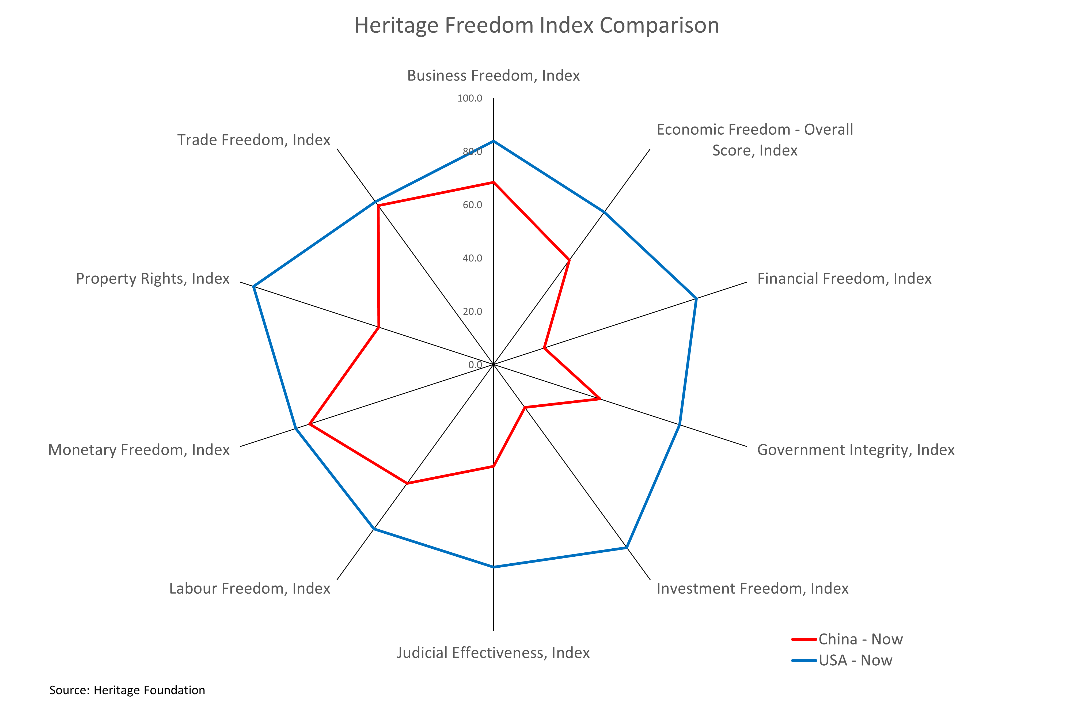

- Much of the dialogue surrounds the power of China. There is no doubt that China has increased its presence around the globe, but we find it hard to see when individuals will want to hold their savings in its currency. The chart below demonstrates the hurdles for China. The Heritage Foundation assembles data on the freedom of different countries. The comparison below is that of the U.S. versus China. The trust in China’s currency is a function of people’s trust in the freedom of operating within the Chinese economy. It appears to have a long way to go.

- We are unsure what ChatGPT references with the lack of the Yen’s lack of global acceptance. What we do know is that Japan is an aging society that has been fighting deflationary trends for over three decades. With few natural resources, a small population, and a considerable level of government debt relative to the size of its economy, it is hard to see the Yen take more on its shoulders.

Prospect: “But the US Dollar’s influence seems to be lessening, doesn’t it?”

Salesperson: “While it’s true that other currencies are growing, the fact remains that international contracts – especially for commodities – are still predominantly denominated in the US Dollar. Its status as the de facto currency for global trade remains unchallenged. Plus, the US military, as the most powerful in the world, provides an extra layer of assurance and stability to the US Dollar’s dominance.”

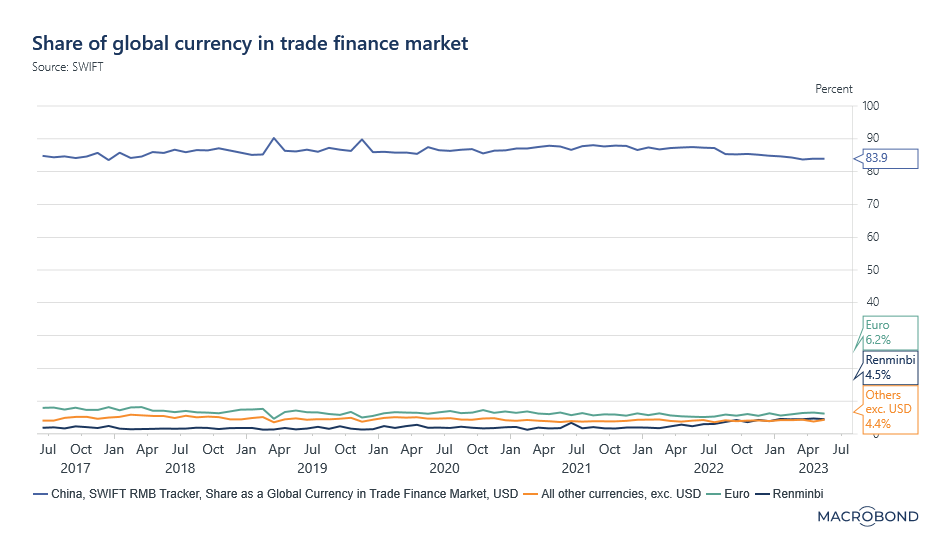

- As China increases its presence within its geographical region, they have been able to execute more trade in Renminbi. However, it still reflects a very small percentage of total global trade. The chart below demonstrates the extent of U.S. dominance in global trade. China’s share has grown but only to the extent of trading with neighboring countries.

Prospect: “You make a strong argument. I hadn’t fully considered all these factors.”

Salesperson: “That’s why I’m here! Ultimately, the choice is yours, but consider the proven stability, liquidity, convertibility, and global acceptance of the US Dollar. Plus, it’s backed by a strong rule of law and the world’s most formidable military force. When weighing the strengths of reserve currencies, these factors should be front and center.”

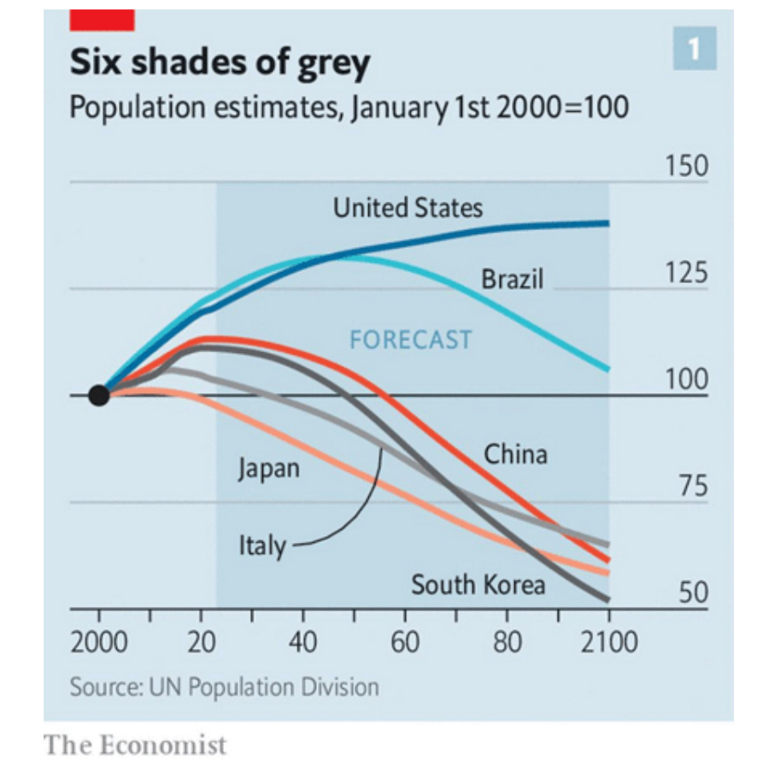

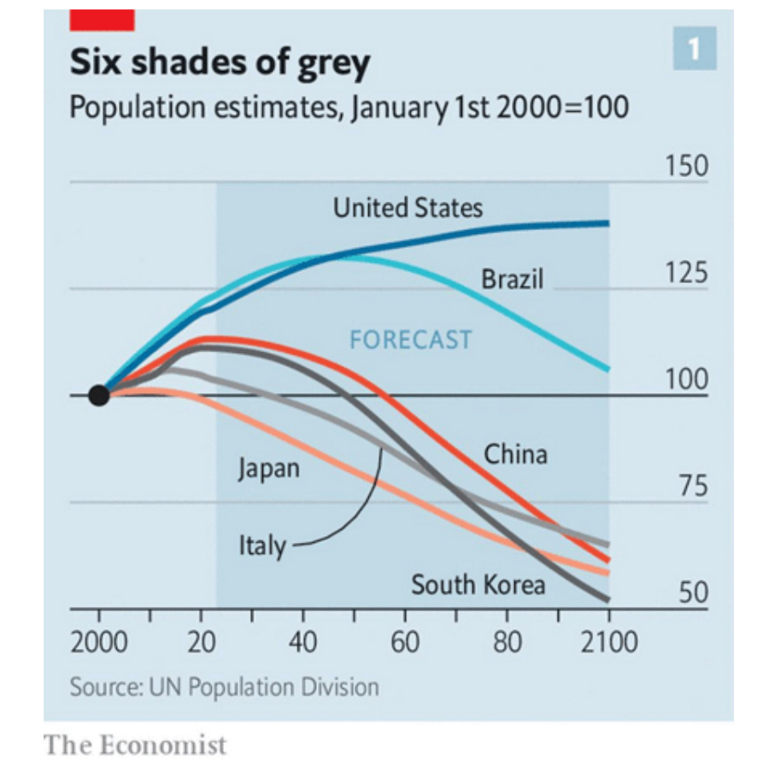

- One item that the AI salesman did not mention is the expected population changes over the next 50 years. The chart below shows the expected changes in population for a set of countries using the year 2000 as the index starting point. The U.S. is expected to grow its population by about 35% over the century, while China could see its population shrink by a third. To put some numbers behind this, China’s working-age population peaked a few years ago at 800 million and is expected to finish the century at 350 million. Economic strength is built on population size, suggesting a headwind for China as we progress through the century.

A currency serves three functions. It must be the unit of measure regarding the value of goods and services, it must be widely used as a medium of exchange, and lastly, it must be a store of value. Many currencies serve at least two of these three. The store of value is the trickier element that filters the list down to just a few.

But to be a reserve currency takes more than just checking those three boxes. It requires trust. Trust that savings can be obtained and converted as demanded by the saver. Trust that the currency’s value will not suffer a significant devaluation on the whim of elected officials. And trust in the political stability of the government backing the currency. Russia has been a recent example of the instability that surrounds authoritative regimes. Though China looks stable, it should not be forgotten that the communist regime has existed for only 100 years and accounts for only 7% of the population. Stability is not a foregone conclusion.

It cannot be guaranteed that the U.S. dollar will maintain its dominance. However, with the information that we see, its demise is highly improbable.

We wish you all a Happy Independence Day.

IMPORTANT DISCLOSURES

This report is for informational purposes only and does not constitute a solicitation or an offer to buy or sell any securities mentioned herein. This material has been prepared or is distributed solely for informational purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. All of the recommendations and assumptions included in this presentation are based upon current market conditions as of the date of this presentation and are subject to change. Past performance is no guarantee of future results. All investments involve risk including the loss of principal.

All material presented is compiled from sources believed to be reliable, but accuracy cannot be guaranteed. Information contained in this report has been obtained from sources believed to be reliable, Auour Investments LLC makes no representation as to its accuracy or completeness, except with respect to the Disclosure Section of the report. Any opinions expressed herein reflect our judgment as of the date of the materials and are subject to change without notice. The securities discussed in this report may not be suitable for all investors and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. Investors must make their own investment decisions based on their financial situations and investment objectives.